Tesla (NASDAQ:TSLA) stock remains one of Wall Street’s most hotly debated names – where opinions often hinge less on fundamentals and more on technology beliefs, political leanings, and the magnetic (or maddening) presence of CEO Elon Musk.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

But one thing’s certain, Tesla has never been measured by traditional auto industry standards. Its valuation still soars far above legacy carmakers, driven in no small part by what many call the “Musk premium.”

Take its latest earnings call. EV deliveries slumped 13% year-over-year – hardly a number to cheer about. Yet, investor excitement didn’t waver. If anything, it surged. Musk’s admission that he would be significantly decreasing his time in Washington to refocus his energy on running Tesla gave the share price a much-needed jolt in the arm.

Since that April 22 earnings call, shares have climbed 25%, even though TSLA remains down 26% year-to-date.

But not everyone is sold on the rebound. One investor, known by the pseudonym Semiconductor Analyst, points out that no matter how strong the rally looks, the valuation story may tell a very different tale.

To cut through the noise, Semiconductor Analyst broke down every piece of the Tesla puzzle in an attempt to assess what the company is actually worth. Interestingly, futuristic projects like robotaxis and humanoid robots didn’t even factor into the valuation, as they were deemed too speculative to include.

“I try not to include businesses that don’t even exist yet in my valuations,” explains Semiconductor Analyst.

Instead, the investor zeroes in on Tesla’s two core engines: EVs and energy. While both remain growth drivers, he argues that even in a bullish scenario, the fundamentals don’t justify the current share price.

“Based on my estimates, that puts the fair value somewhere around $205/share ($165 for auto + $40 for energy) – which keeps me on the sidelines for now,” says Semiconductor Analyst, who rates TSLA shares a Hold (i.e. Neutral). (To watch Semiconductor Analyst’s track record, click here)

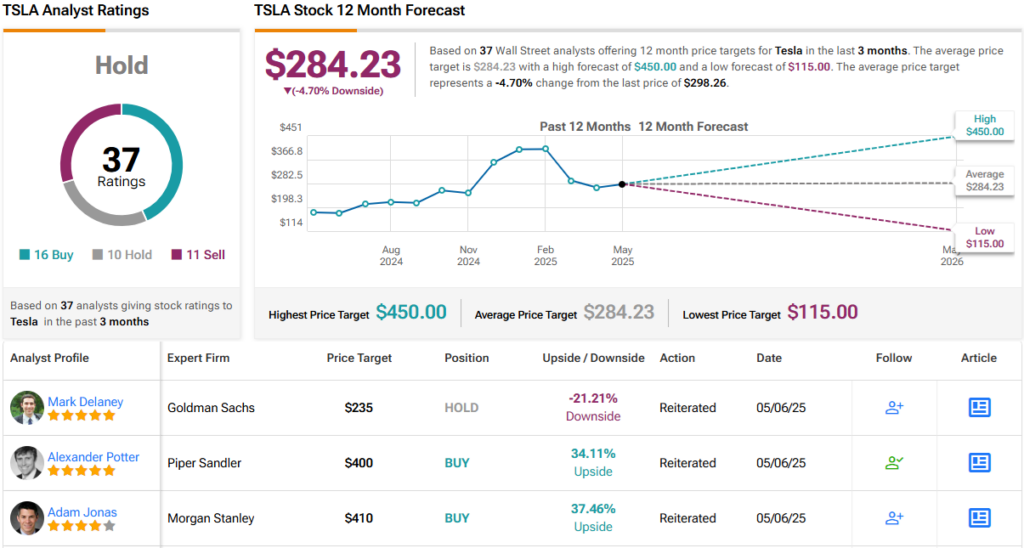

As for Wall Street, the jury’s still out. With 16 Buys, 10 Holds, and 11 Sells, analysts are nearly evenly divided, leaving TSLA with a consensus Hold rating. The average 12-month price target stands at $284.23, suggesting a ~5% downside from current levels. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.