Tesla (NASDAQ:TSLA) appears to have left its disastrous delivery trajectory behind, with the EV giant’s just-released Q3 numbers handily beating Street expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla delivered 497,100 vehicles in the quarter, setting a new company record and topping consensus expectations of 448,000, as many buyers moved quickly to take advantage of the expiring $7,500 government tax credit. That is a much-improved number vs. 1Q25, during which Tesla delivered 336,681 vehicles and 2Q25, when it notched 384,122 deliveries. In the same period last year, Tesla delivered 462,890 units.

Model 3/Y deliveries totaled 481,200, exceeding Wall Street’s 425,100 forecast, while deliveries of other models reached 15,900, just shy of the 16,000 expected by the analysts.

It seems that China remains a strong market for Tesla despite mounting competition from lower-cost models by BYD, Nio, Xpeng, and others. Demand has been bolstered by the updated Model Y, while the new six-seat version has quickly gained momentum, accounting for roughly 20% of Tesla’s total registrations in the country. Europe, meanwhile, continues to be a more challenging market given intensifying EV competition, though Tesla has started to see some signs of stabilization as it attempts to hold on to market share.

Scanning the numbers, Wedbush’s Daniel Ives, who ranks among the top 4% of Street stock analysts, sees reasons to be optimistic, although he does not get too carried away.

“While EV demand is expected to fall with the EV tax credit expiration, this was a great bounceback quarter for TSLA to lay the groundwork for deliveries moving forward, but there is still work to do to gain further ground from a delivery perspective,” Ives went on to say.

However, as Ives himself has repeatedly stated, vehicle deliveries are not what’s driving the Tesla narrative anymore. Boosted by the ramp-up of full-scale production across its autonomous and robotics initiatives, Ives sees Tesla potentially achieving a $2 trillion market cap by early 2026 and reaching $3 trillion by year-end.

“The AI valuation will start to get unlocked in the Tesla story, and we believe the march to an AI driven valuation for TSLA over the next 6-9 months has now begun in our view with FSD and autonomous penetration of Tesla’s installed base and the acceleration of Cybercab in the US representing the golden goose for Musk & Co,” the 5-star analyst summed up.

All in, Ives assigns TSLA shares an Outperform (i.e., Buy) rating, backed by a Street-high price target of $600. This figure reflects his belief in ~36% upside heading into next year. (To watch Ives’ track record, click here)

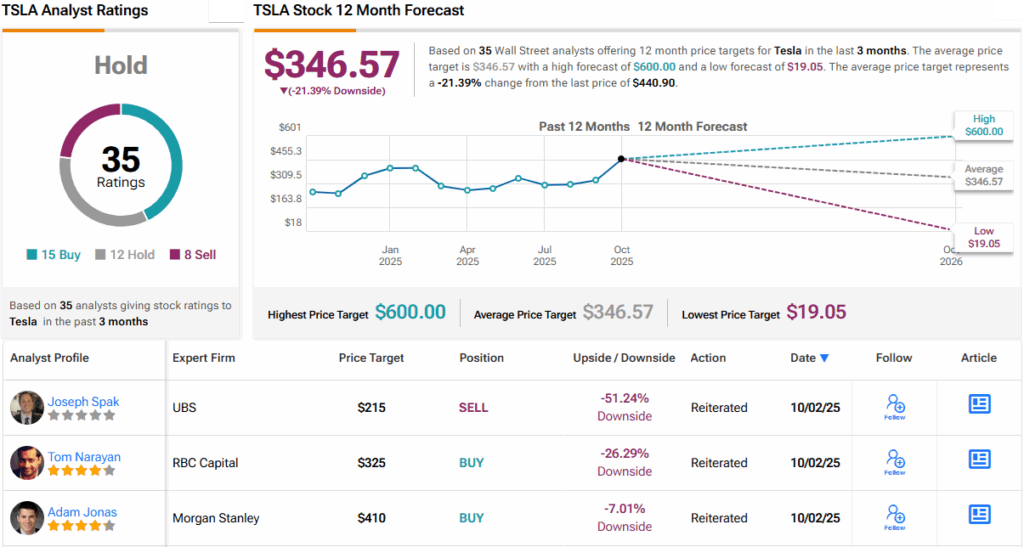

Most on the Street are far less bullish; TSLA stock claims a Hold (i.e., Neutral) consensus rating, based on a mix of 12 Holds, 15 Buys and 8 Sells. Meanwhile, the forecast calls for a 12-month drop of 21%, considering the average price target stands at $346.57. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.