Tesla (NASDAQ:TSLA) stock has faced difficulties in 2025, weighed down by a string of underwhelming earnings reports marked by shrinking deliveries, revenue, and profits; on the Q2 call, CEO Elon Musk even warned investors to brace for more tough quarters ahead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ordinarily, such warnings would spook Wall Street and send investors running for the exit gates. Yet Tesla has proven to be an exception. While the stock has suffered at times this year, it has ultimately brushed away the concerns and tilted into the green, climbing 53% higher over the past 6 months.

That resilience speaks to something bigger than the quarterly numbers. Musk – along with a cohort of market watchers – has often stressed that Tesla’s ambitions stretch far beyond simply being a car maker, a narrative that has become even more pronounced as the core EV business has struggled.

Investors have clearly bought into that broader vision, and now Baird analyst Ben Kallo appears to be doing the same.

“We underestimated the look-through in the core Automotive business,” says the analyst, pointing to the stock’s recent success in spite of the lackluster quarterly showings. “Maintaining our view that volumes will likely decline again in full-year 2025 and near-term fundamentals will be choppy, we now expect shares to Outperform as TSLA is increasingly viewed as the leader in physical AI,” Kallo further said.

From his perspective, the story is now being driven by a slate of forward-looking catalysts – everything from the reveal of the next-generation Optimus to new robotaxi markets, the Tesla Semi, a lower-cost vehicle, broader adoption of Dojo, and expansion in the Energy business. Looming large among these is the shareholder-approved compensation plan that directly ties Musk’s incentives to hitting unprecedented milestones.

The plan involves a $1 trillion pay package linked to Tesla reaching a market cap as high as $8.5 trillion, delivering 20 million vehicles, producing 1 million robots and robotaxis, hitting 10 million FSD subscriptions, and pushing adjusted EBITDA as high as $400 billion.

Kallo runs the math on what those goals could mean. In the minimum scenario, hitting the base milestones by 2035 would put Tesla’s market cap around $5.5 trillion and shares at about $1,412 after dilution. In a more bullish case – doubling the volumes – the company could approach a $12 trillion valuation with shares near $3,043.

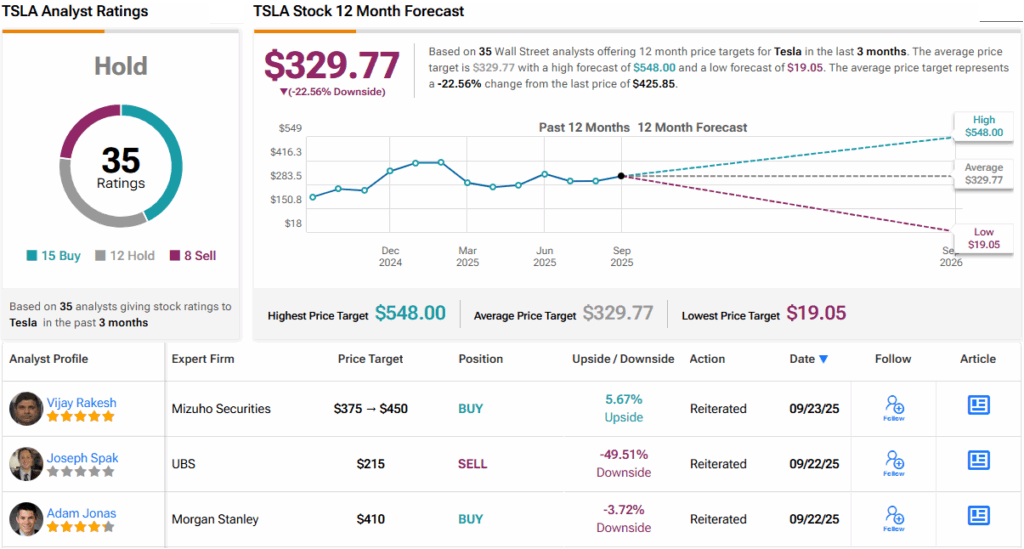

On that basis, Kallo sees justification for an upgrade. The analyst lifts his rating on TSLA from Neutral to Outperform (i.e., Buy) and boosts his price target from $320 to a Street-high $548, implying another ~29% upside in the months ahead. (To watch Kallo’s track record, click here)

Consensus on Wall Street, however, remains divided. While 14 other analysts join Kallo in the bull camp, there are still 12 Holds and 8 Sells, all coalescing into a Hold (i.e., Neutral) consensus rating. The $329.77 average price target points to a one-year decline of 22.5%, underscoring just how polarizing Tesla stock remains. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.