Tesla stock (TSLA) slid 1.5% in pre-market trading on Friday morning as a new bearish rating from BNP Paribas Exane (BNPQY) reignited debate over the electric vehicle giant’s lofty valuation. The drop followed a relatively strong start to the week, during which shares had climbed 3.7% before Friday’s pullback.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BNP Paribas Issues Sell Rating, Targets Sharp Downside

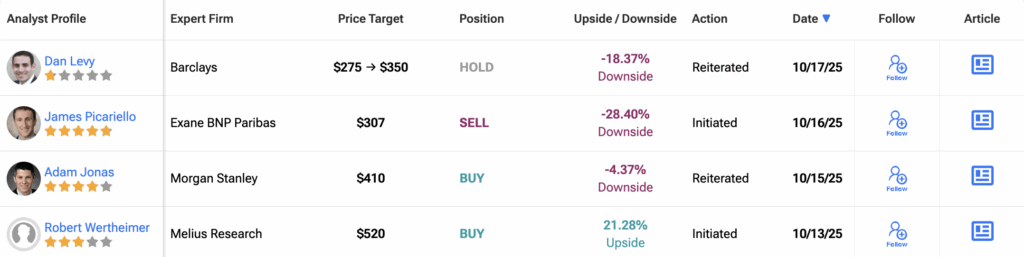

Adding fuel to the sell-off, BNP Paribas analyst James Picariello initiated coverage with a Sell rating and a stark $307 price target. This implies a 27% downside from current levels. According to Picariello, Tesla’s trillion-dollar-plus market cap is being propped up largely by expectations for its artificial intelligence businesses—robo-taxis and humanoid robots—which currently generate zero revenue.

“We see room for AI-driven upside long-term, but the valuation already implies quite a lot,” Picariello said in his note.

His view aligns with a broader trend among traditional auto analysts, who typically assign lower multiples to Tesla than tech-focused analysts. Even so, Picariello’s target values Tesla at roughly 150 times estimated 2026 earnings. The current trading level exceeds 200 times forward earnings.

Momentum Slips as Investors Brace for More Volatility

Despite Friday’s dip, Tesla stock remains up 6% year to date and nearly 94% over the past 12 months. That said, the ride has been anything but smooth. Over the last 30 trading sessions, shares have swung an average of 2.7% daily, with double-digit intraday moves becoming more frequent.

Last week, the stock dropped 3.8% before rebounding. This week, it had clawed back gains, until new concerns surfaced on Friday.

Key Takeaway

Tesla’s high-flying valuation continues to face scrutiny as another major analyst issues a warning. While the long-term narrative remains rooted in AI and automation, the lack of current revenue from those segments is drawing increased skepticism. It seems like Wall Street is recalibrating its expectations, and Tesla stock is naturally feeling the pressure.

Is Tesla Stock a Buy, Hold, or Sell?

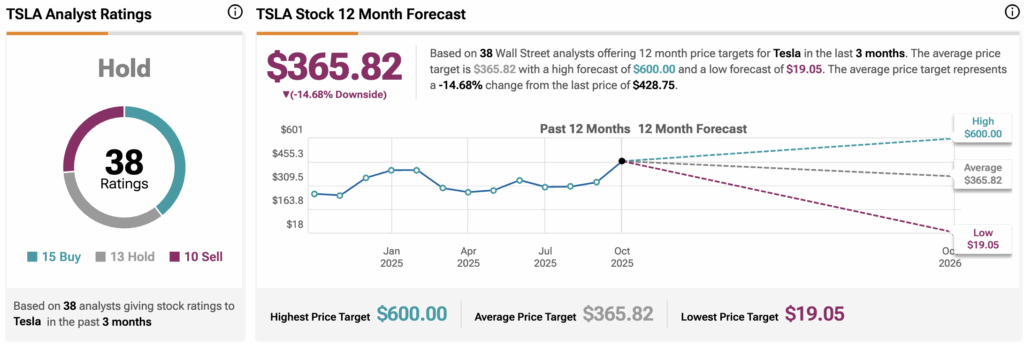

Tesla continues to be one of Wall Street’s most divisive stocks. According to the latest data, just 15 of 38 analysts rate Tesla stock a Buy, representing only 39% of coverage. This trails the S&P 500 average of around 55%. Meanwhile, 13 analysts rate it a Hold, and 10 call it a Sell.

That Sell ratio is particularly stark. Nearly 25% of analysts now recommend selling Tesla stock, which is more than double the S&P 500 average of 10%.

The average 12-month TSLA price target is $365.82, implying a downside potential 14.7%.