Tesla (TSLA) rival BYD Co. (BYDDF) (BYDDY) ended 2024 on a positive note, with an impressive 73.1% year-over-year surge in its Q4 profit to RMB 15 billion ($2.1 billion). Moreover, the Chinese auto giant reported a nearly 53% rise in its Q4 2024 revenue to RMB 274.9 billion ($37.9 billion). The solid growth rates were driven by a 61.3% increase in BYD’s NEVs (new energy vehicles) to 1,524,270 in the quarter.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

While the top and bottom lines beat expectations, the decline in the company’s Q4 gross margin was a matter of concern. BYD’s Q4 2024 gross margin declined to 17.0% from 21.9% in Q3 2024 due to higher costs.

Overall, BYD delivered 595,413 battery electric vehicles (BEVs) and 918,556 plug-in hybrid vehicles (PHEV), reflecting growth of 13.1% and 120.7%, respectively, in Q4 2024.

BYD Gives Tough Competition to Tesla

BYD is emerging as a major threat to Elon Musk-led Tesla. In the full year 2024, BYD’s revenue grew 29% to RMB 777.1 billion or over $100 billion, outperforming Tesla’s revenue of $97.7 billion. Also, net profit increased 34% to RMB 40.3 billion. However, in terms of dollars, BYD’s full-year profit of $5.5 billion lagged Tesla’s $7.1 billion. That said, BYD is well-positioned to boost its profits with its rapid growth and continued innovation.

Tesla, meanwhile, disappointed investors by reporting its first decline in annual deliveries in over a decade, with sales falling by 1.1% to 1.79 million units in 2024. Investors are increasingly concerned about the impact of intense competition and Musk’s political activities on the American EV maker.

BYD continued last year’s strong run into 2025 and reported a 49% year-over-year rise in January NEV deliveries and a 161% jump in February NEV deliveries. The company recently impressed investors by announcing the launch of a new battery technology that it claims can charge a vehicle in the same time it takes to fill fuel in a car. While BYD is upbeat about its expansion into international markets, tariffs might pose significant headwinds.

Is BYD Stock a Buy, Sell, or Hold?

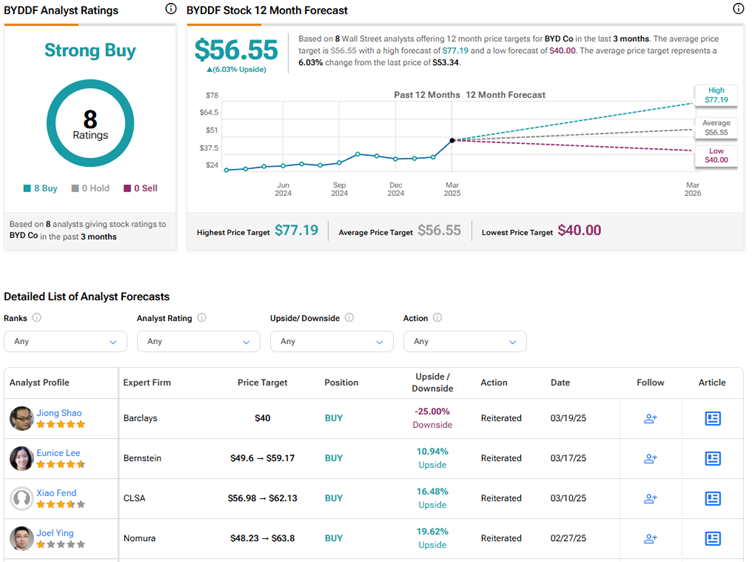

Wall Street is highly bullish on BYD Co. stock, with a Strong Buy consensus rating based on eight unanimous Buys. The average BYDDF stock price target of $56.55 implies 6% upside potential. BYDDF stock has rallied 57% year to date.