Tesla (TSLA) said on Monday it would release its smart driving software in China after regulatory approval after reports that a free trial of its Full Self-Driving service had been paused.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to Reuters, Tesla’s customer support posted a comment under a feed of Tesla vice president Grace Tao’s Weibo account to tell customers that it was awaiting regulatory approval for the service before proceeding.

“All parties are actively advancing the relevant process and we will push it to you as soon as it is ready. We are also looking forward to it, please wait patiently,” Tesla posted on the Chinese social media platform. It comes just a week after Tesla announced it would offer a free trial of its FSD service in China between March 17th and April 16th.

FSD Hits China Speed Bumps

Unlike in the U.S., Tesla has struggled to incorporate the latest map information in its FSD product in China since data laws means it is unable to train the system with the roughly 2 million Tesla vehicles on the country’s roads.

Last Monday the company launched a free trial to for “customers to experience Tesla’s in-house developed advanced assisted driving features for free.”

While Tesla wants more drivers to experience FSD, it does not seem it’s quite ready. In late February the EV maker began rolling out FSD-like smart driving features in China, though its announcement made no reference to FSD. All Tesla vehicles in China are equipped with the free Basic Autopilot (BAP) software, but FSD is yet to make it there.

Tesla is said to be working with Chinese tech giant Baidu (BIDU) as it aims for a full rollout of FSD this year.

It comes amid a bitter price war and struggle for dominance of autonomous driver technology, which is increasingly being offered for free or with steep discounts to encourage purchases. Most automakers, including Xpeng (XPEV) and BYD (HK:1211) (BYDDF), offer ADAS (Advanced Driver Assistance System) features for free.

Is Tesla a Good Buy?

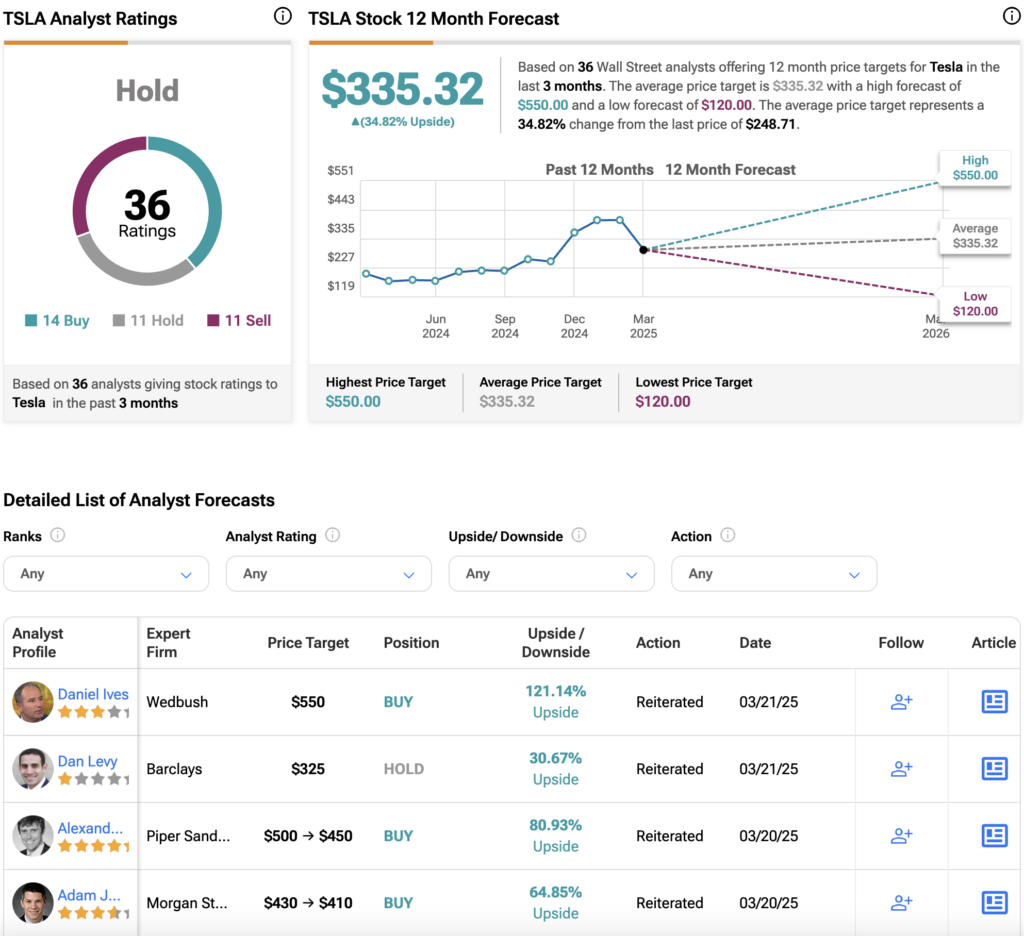

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 11 Holds, and 11 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $335.32 per share implies about 35% upside potential.