Tesla (NASDAQ:TSLA) will be curtailing production of its EV semitrailer truck, citing concerns about supply chain issues. CEO Elon Musk announced that due to battery supply constraints, it does not plan to commence production of its new electric semitrailer truck, the company’s niche product, in larger volumes until the end of 2024. The first trucks were delivered in December 2022, five years after the model was originally launched.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, at an energy conference in Austin, Texas, on Tuesday (June 13), Musk reiterated his devotion to EV trucks. He said that heavy trucks account for a significant share of vehicle emissions and thus the company plans to look at more sustainable energy options. Moreover, he forecasts electricity demand to triple around 2045 with more and more drivers seeking EVs.

Separately, the automaker marked a third price hike for the Model Y in the U.S. However, prices remain below the levels they were at before the cuts commenced. From January 2023 until April, the company slashed prices globally to push volumes higher.

Is Tesla a Buy or Sell Rating?

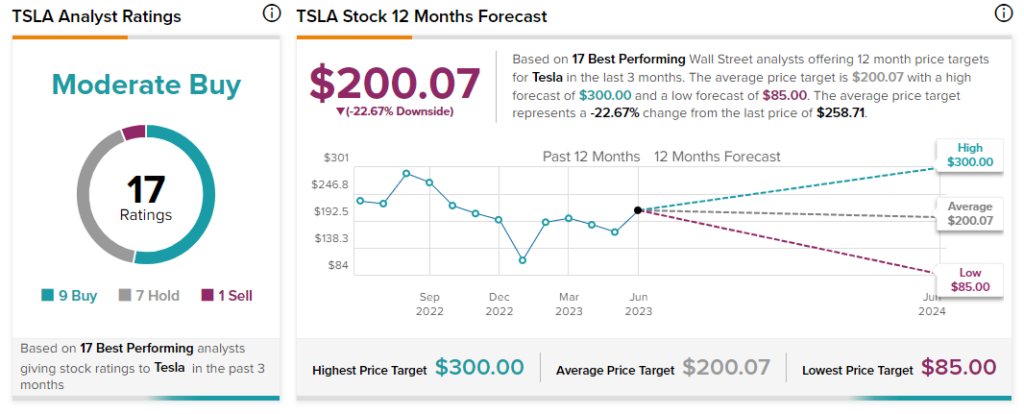

Of the 17 Top Wall Street Analysts covering the stock, nine rate it a Buy while seven have assigned a Hold rating taking the consensus to a Moderate Buy. The average price target stands at $200.07 marking a 22.7% downside potential to the stock.

Yesterday (June 13), Morgan Stanley Analyst Adam Jonas reaffirmed his Buy rating on the stock. Supporting his rating, the analyst believes that it is now time for Tesla to offer full-line financial services (Finco) through a large, full-scale captive financing subsidiary. Its rapidly expanding customer base may require new solutions for financing and thus the rating firm sees it as a major growth driver for the company and the stock.

In the past 3-months, the stock gained 41.2% after Tesla opened its fast-charging network to General Motors (NYSE:GM) and Ford Motor (NYSE:F) customers. Year-to-date, the stock has skyrocketed 139.3%.