Sales of Tesla’s (TSLA) China-made electric vehicles plummeted in January as competition from domestic rivals intensified. TSLA sold 63,238 units of its EVs last month, down 11.5% from the 71,447 sold during the same month a year ago.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

TSLA stock nudged down more than 1% in premarket trading after notching a 1% decline on Thursday to take its weekly decline to over 6% amid fears Elon Musk’s company could be embroiled in a trade war between Washington and Beijing.

Contrasting with Tesla sales, Chinese rival BYD (BYDDF) sold 296,446 pure electric and plug-in hybrid vehicles in January, up 47% year-on-year, albeit down almost 42% from the prior quarter. Sales for Xpeng (XPEV) also rose, the figures from the China Passenger Car Association showed.

Tesla has faced increasingly stiff competition in China and has turned to price cuts and offers to stem the tide. The company reduced the price of its Model Y and extended a zero-interest five-year loan deal until the end of January.

This came after Tesla lost more market share to domestic rivals, down from 7.8% in 2023 to 6% in the first 11 months of last year. Sales of its Chinese-manufactured Model 3 and Model Y cars in January were down 32.6% from December.

TSLA Sales in Europe Plunge Too

Chinese sales are not the only headache. Earlier this week figures showed Tesla sales in Germany plunged 59% in January, with only 1,277 new cars registered, the lowest monthly total since July 2021. Sales were also down 63% in France and by 12% in the UK.

Meanwhile, Tesla is lifting the price of its Model X variants in the U.S. by $5,000, according to the company’s website.

What is the Prediction for TSLA Stock?

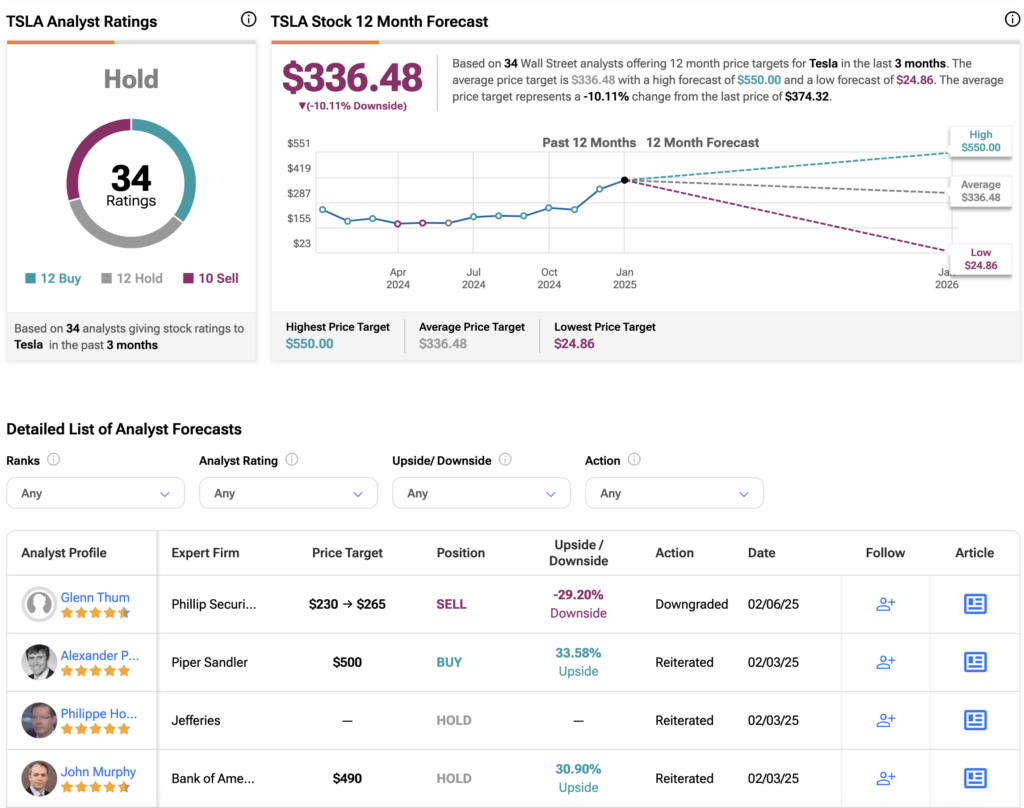

Overall, TSLA stock has a Hold consensus rating based on 12 Buys, 12 Holds, and 10 Sell ratings. The average Tesla price target of $336.48 implies 10% downside potential from current levels.