New Street Research analyst Pierre Ferragu raised his price target on Tesla (TSLA) stock to a street-high of $600 (from $520), implying 38.6% upside potential. A longtime Tesla bull, Ferragu dubbed CES 2026 “The Great Validation Chamber” for Tesla’s autonomous-driving efforts. He maintained his Buy rating, citing two key CES events that validate Tesla’s autonomy strategy such as Full Self-Driving (FSD), and emphasized the industry’s 12-year lag.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

First, Mobileye’s (MBLY) push for cost-efficient L2+ hardware enables mass-market adoption across a wide range of vehicle models. Second, Nvidia’s (NVDA) new Alpamayo platform uses AI to speed autonomous-driving development. These moves signal that rivals are validating Tesla’s approach, with a 12-year lag.

Ferragu is a five-star analyst on TipRanks, ranking #639 out of 10,186 analysts tracked. He has a 66% success rate and an average return per rating of 20.30%.

Mobileye’s L2+ Hardware Pivot

Ferragu noted that Mobileye’s move to standardize cost-efficient L2+ hardware is equivalent to Tesla’s HW2 from 2016, for deployment in 2028. This suggests that Mobileye and Western OEMs (original equipment manufacturers) have effectively abandoned L4 ambitions, prioritizing scalability over full autonomy. For context, L2 offers partial automation (driver must supervise), while L4 enables driverless operation in specific areas.

This leaves Tesla with a 12-year robotaxi lead, as competitors retrofit outdated tech into future fleets, ceding ground to Tesla’s iterative hardware-software stack.

Nvidia’s Shift to Reasoning AI

Nvidia’s “Alpamayo” platform endorses Tesla’s end-to-end neural network by shifting Physical AI toward advanced reasoning. This implies a complete vindication for Tesla’s FSD V13/V14 design, where the integrated stack processes raw data into decisions seamlessly.

Ferragu believes that go-to-market execution remains a major bottleneck. Nvidia supplies the “kitchen” (chips and models), but legacy OEMs must still “cook” viable autonomy. Their fragmented approaches and regulatory hurdles make rapid scaling unlikely, widening Tesla’s lead.

Should You Buy Tesla Stock?

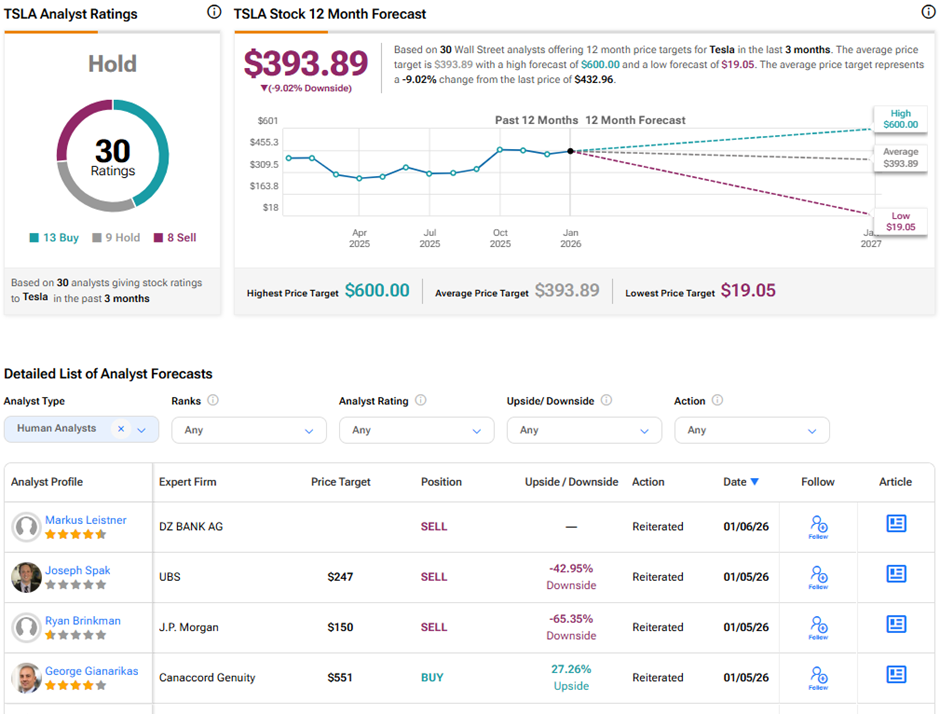

Analysts remain sidelined on Tesla stock currently. On TipRanks, Tesla has a Hold consensus rating based on 13 Buys, nine Holds, and eight Sell ratings. The average Tesla price target of $393.89 implies 9% downside potential from current levels. Over the past year, TSLA shares have gained nearly 10%.