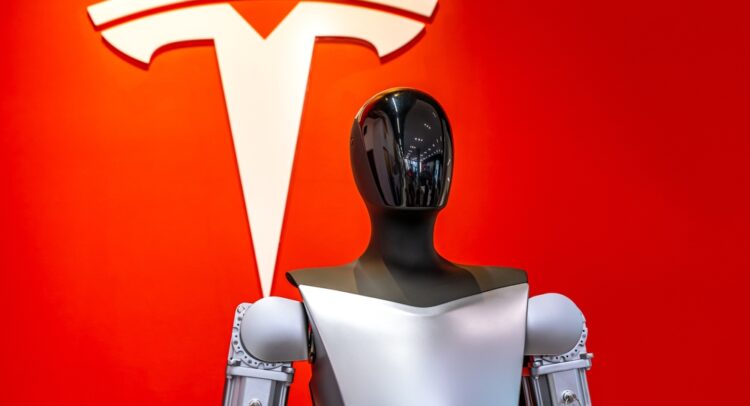

Tesla Inc. (TSLA) unveiled its Master Plan Part IV, setting a fresh direction for the company. Instead of focusing on electric vehicles, the new plan highlights artificial intelligence and robotics as the primary drivers of future growth. Chief Executive Elon Musk claimed that about 80% of Tesla’s long-term value will come from its Optimus humanoid robot project – an extremely bullish statement from his part.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The document, shared on Musk’s X account, is different from earlier plans that included specific roadmaps. This version reads more like a broad vision for what Musk calls a “technological renaissance,” where robots take on routine tasks and self-driving cars reshape transport. The plan mentions “sustainable abundance” as the goal, but offers few measurable steps on how to get there.

Optimus Targets

At the center is the Optimus robot, which is still in development. According to Musk, Optimus units are already doing simple work in Tesla facilities. He projected production of 5,000 robots in 2025, scaling to 1 million per year by 2029. Tesla expects to launch Optimus 3 prototypes by the end of 2025, with mass production set to begin in 2026. Each unit is expected to cost between $20,000 and $30,000. Sales will start with businesses and then expand to consumers.

Criticism and Concerns

Despite the grandiose plan, some voices in the industry responded with skepticism. Fred Lambert, editor-in-chief of Electrek, an online publication for electric vehicles and renewable energy news, said the plan was “a smorgasbord of AI promises about its humanoid robot, which can’t even serve popcorn.” Echoing Optimus’s reported struggles to serve popcorn at Tesla’s L.A. diner location. Another publication that voiced its skepticism was TechCrunch, which wrote the paper read “like LLM-generated nonsense.” Ars Technica, a news and technology site, also noted the lack of detail. Musk himself admitted on X that the absence of specifics was “a fair point” and promised more information later, without giving a timeline.

Shifting as Sales Decline

The new direction comes as Tesla’s vehicle business weakens. Global deliveries fell 13% in the first half of 2025. In Europe, sales were down 40% in July, while the Chinese market dropped 5.4% year-over-year during the same period. Shares of Tesla are down almost 19% in 2025, trading at $329.36 on Tuesday. The company’s market capitalization stands at $1.06 trillion, compared with Nvidia’s (NVDA) $4.09 trillion market cap. Musk has previously suggested Tesla could one day reach a $25 trillion valuation, with Optimus contributing most of that figure.

Is Tesla a Buy, Sell, or Hold?

On the Street, Tesla currently boasts a Hold consensus rating from Wall Street analysts based on 35 reviews. The average price target stands at $306.42, suggesting a downside of 6.97% from the current price.