EV maker Tesla (TSLA) has become the most popular imported car brand among South Koreans in their 20s and 30s in 2025. From January through November, buyers in this age group purchased more than 21,000 Teslas, far surpassing brands like BMW (BAMXF) and Mercedes-Benz (MBGAF). According to experts cited by The Economist, this surge is due to a growing “fandom culture,” in which younger consumers choose the brand itself rather than carefully comparing traditional vehicle features.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

When looking at the numbers more closely, the Model Y stands out as the clear favorite. Data from the Korea Imported Automobile Association shows that Tesla sold 21,757 vehicles to people in their 20s and 30s through November, compared with 13,666 for BMW and just 6,983 for Mercedes-Benz. Young men accounted for roughly 16,000 Tesla purchases, with more than 15,000 of those being Model Y vehicles, followed by the Model 3. Young women showed a similar pattern of preferring the Model Y first and the Model 3 second, while the Cybertruck saw very limited interest.

The Model Y’s popularity comes from its practical SUV design, impressive driving range of roughly 400 to 500 kilometers, quick acceleration, and generous cargo space. At the same time, the Model 3 appeals as a more affordable entry option, especially with South Korea’s EV subsidies. Experts note that many young buyers view Tesla more as a tech gadget than a traditional car, which helps explain why recalls and controversies have had little impact, especially since most fixes are handled through software updates.

What Is the Prediction for TSLA Stock?

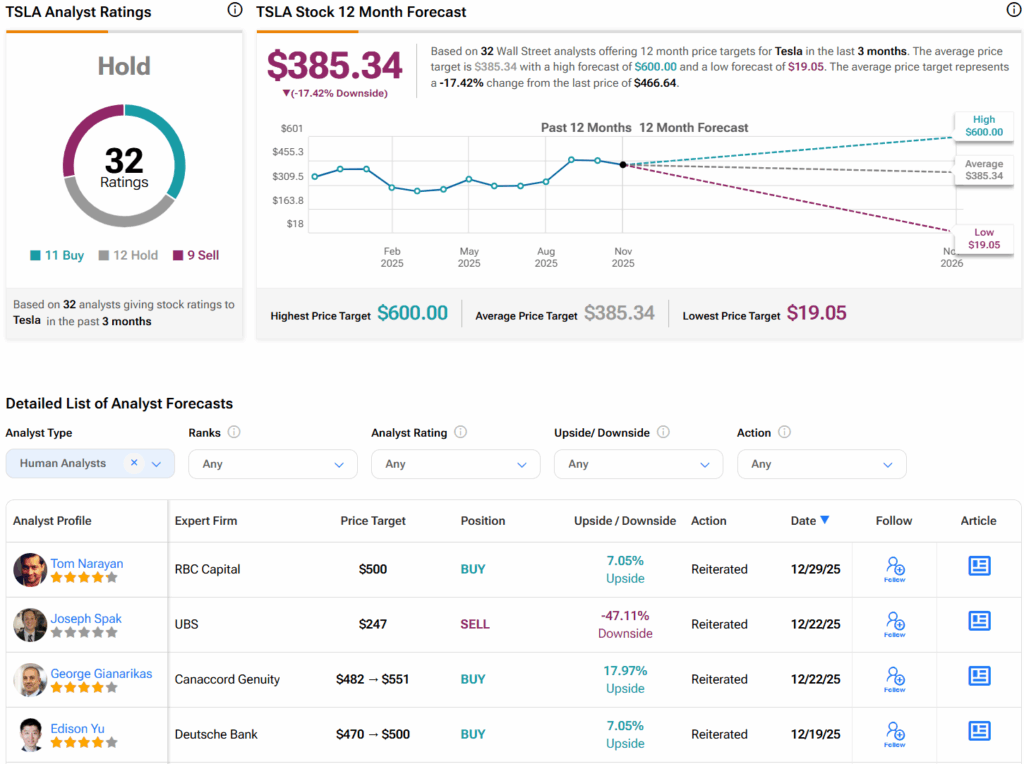

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 11 Buys, 12 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $385.34 per share implies 17.4% downside risk.