It has not been a great year for aerospace company Boeing (BA). Now, a new media report says it may take a decade for the company to recover from a recent labor strike and safety issues with its aircraft.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Boeing has lost $24 billion since 2019. The first nine months of this year is on track for an additional $8 billion loss, and the share price is down a whopping 67% from their highs in 2018. The Alaska Airlines (ALK) door plug debacle, the Starliner calamity that left two astronauts on the international space station, and a machinists’ strike have all hurt Boeing’s finances and its share price.

All is not lost, though. Boeing has a hefty book of unfilled orders that it can work on, and a duopoly in the commercial aircraft space. This ultimately led to Leeham Co. managing director Scott Hamilton to declare that it could take Boeing a full decade to recover from all the hits it has taken.

The Boeing Space Sale

In other news, a potential sale of Boeing’s space assets is being viewed as a positive for the company. Things like the now-infamous Starliner spacecraft, and the Vulcan rocket, could be up for sale. While such a move would get Boeing off of Florida’s Space Coast, a position it has occupied since the Apollo program, it may also prove good news as it generates much needed capital for the company.

And to top it off, details have emerged about new Boeing CEO Kelly Ortberg’s pay package of $1.5 million guaranteed, with a $1.25 million payment coming in December of this year. He is also in line to get $16 million in stock awards over the next few years.

Is Boeing a Good Stock to Buy?

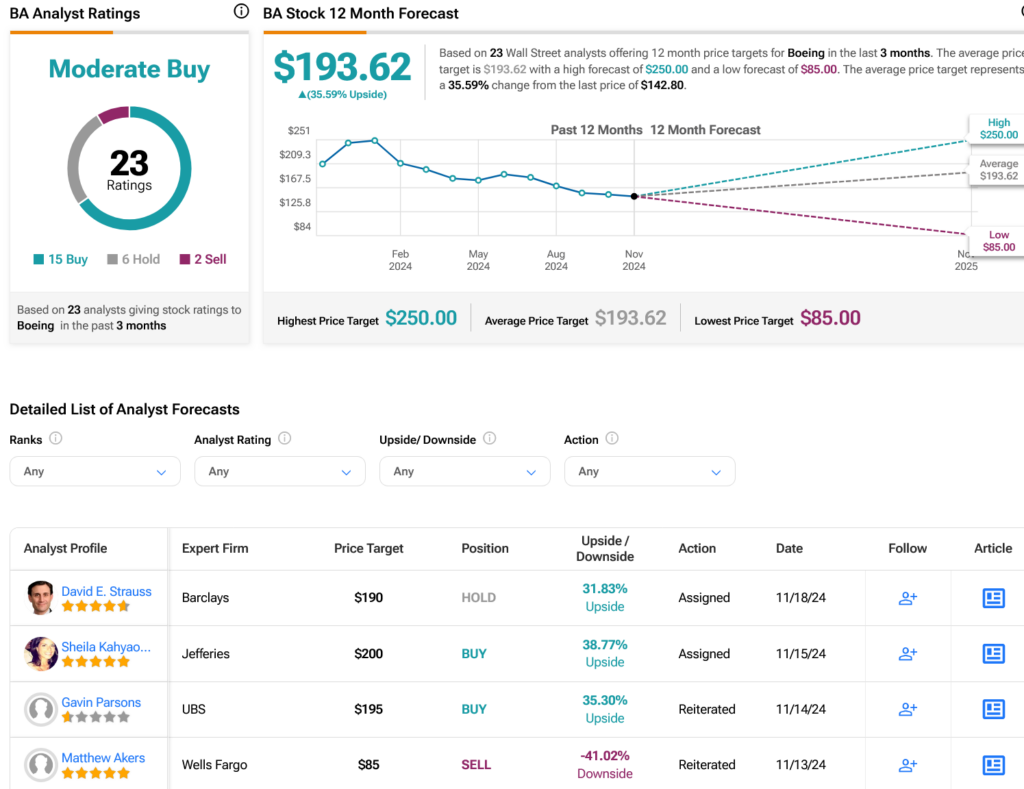

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, six Holds, and two Sells assigned in the last three months, as indicated by the graphic below. After a 33.8% loss in its share price over the past year, the average BA price target of $193.62 per share implies 35.59% upside potential.