PDD Holding’s (PDD) e-commerce platform, Temu, and a privately held online retailer, Shein, have recently seen a major drop in their U.S. sales, Bloomberg reported. The fall comes after U.S. President Donald Trump announced he would eliminate a duty exemption on import of goods valued under $800 from China. It is worth noting that this exemption, called the de minimis trade exemption, played a key role in the rapid growth of Chinese retailers like Temu and Shein, which provide low-cost goods to U.S. consumers.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shein’s U.S. sales dropped by 16% to 41% over five days starting February 5, while Temu saw a decline of up to 32% during the same period, according to Bloomberg’s data. While the post-Christmas slowdown and increased competition may have contributed to the fall, the threatened removal of the duty exemption is likely the primary factor that affected consumer spending on these platforms.

Although the policy change has not yet been put into effect, it has created uncertainty among consumers, who may now be hesitant to purchase from these platforms due to the potential for unexpected import duties.

Temu and Shein Make Efforts to Mitigate Tariff Impact

In response, Shein and Temu are actively seeking to mitigate the impact of these new tariffs. Temu is altering its supply chain, moving away from its original model where sellers depended on Temu for pricing, shipping, and marketing. Instead, the company is adopting a “half-custody” approach, where factories are responsible for shipping their goods in bulk to American warehouses.

Meanwhile, Shein is encouraging its suppliers to shift production to Vietnam. Nevertheless, the new tariffs policies are likely to impact their businesses in the near term and might increase costs for consumers.

Is PDD Stock a Good Buy?

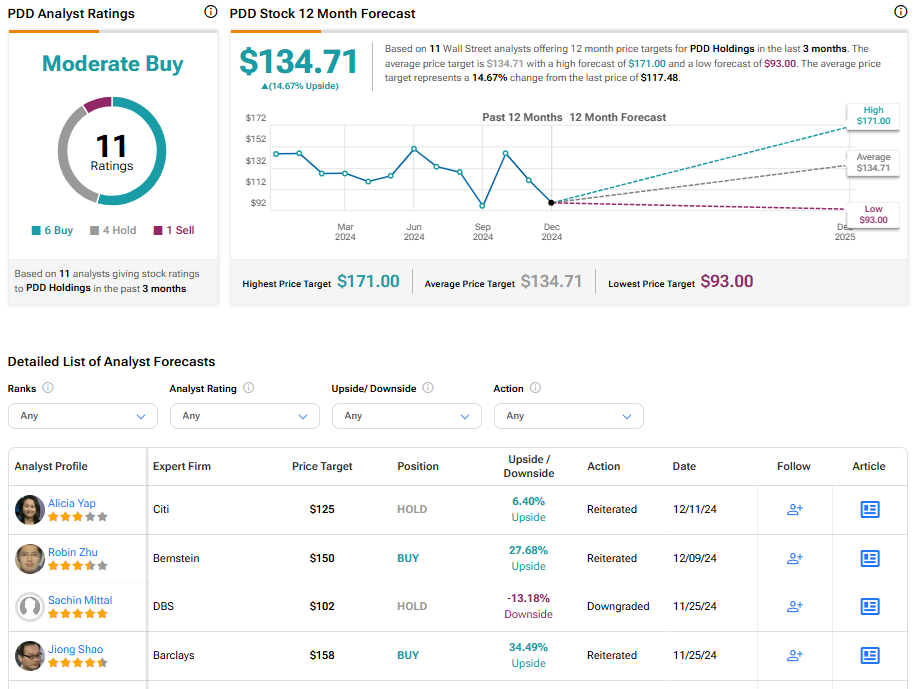

Turning to Wall Street, PDD stock has a Moderate Buy consensus rating based on six Buys, four Holds, and one Sell assigned in the last three months. At $134.71, the average PDD Holdings stock price target implies a 14.67% upside potential. Shares of the company have declined 17.54% over the past six months.