Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made notable portfolio moves on Monday, January 5, as revealed in daily fund disclosures. The trades reflect ARK’s continued focus on disruptive innovation in biotech, autonomous driving, blockchain, and fintech, while trimming positions in areas showing slower growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Here Are Wood’s Trades

The largest trade was the purchase of 228,626 shares of health-tech company Tempus AI (TEM) through the ARK Innovation ETF (ARKK) and the ARK Genomic Revolution ETF (ARKG). The combined purchase amounted to $14.79 million based on Monday’s closing price.

Tempus leverages AI to process genomic sequencing, clinical records, and other medical data, initially focusing on oncology but expanding to areas like cardiology, mental health, and beyond. TEM stock gained 3.75% yesterday amid a broader AI and tech rally. Wood also bought $5.54 million in TEM shares on January 2, when shares were up 5.6%.

At the same time, the ARK Autonomous Technology & Robotics ETF (ARKQ) added 53,302 shares of Kodiak AI (KDK), which develops AI-powered autonomous trucking solutions for driverless freight delivery. KDK stock was down nearly 4%. Also, the ARKG fund bought 47,587 shares of cancer-genomics company Personalis (PSNL).

On the sell side, Wood continued trimming exposure to Canadian e-commerce portal Shopify (SHOP), streaming giant Roku (ROKU), biotech firm Guardant Health (GH), and genetic-testing company Natera (NTRA). The largest trade was the sale of 109,254 shares of ROKU for $12.53 million.

Wood’s Strategic Portfolio Shuffle

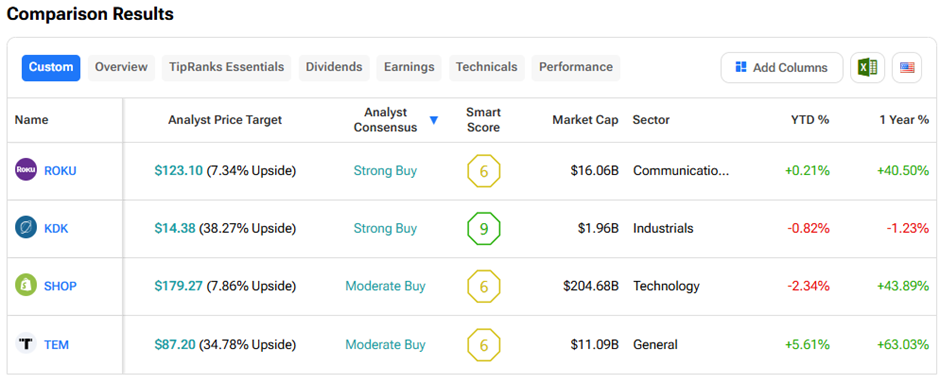

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool:

Currently, analysts have a “Strong Buy” consensus rating on Roku and Kodiak shares, with KDK stock offering a higher upside potential among them. Meanwhile, analysts remain divided on Shopify and Tempus AI shares.