Telegram is set to raise at least $1.5 billion through a fresh bond sale, and it’s bringing heavyweight names with it. According to the Wall Street Journal, BlackRock (BLK), Mubadala, and Citadel are among the firms lining up for the deal. They’re drawn by a double-digit return profile and discounted access to a future IPO.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The five-year bonds will carry a 9% yield, according to sources familiar with the terms. But what’s really catching institutional interest is the 20% discount to Telegram’s eventual IPO, built into the deal structure. For firms like BlackRock, that’s a rare blend of steady yield and upside optionality.

Proceeds Target 2021 Debt Buyback

Telegram plans to use the capital to repurchase bonds it issued in 2021, which mature in March 2026. Those bonds helped fund Telegram’s global growth over the past few years, and this new raise appears aimed at refinancing under better terms — and ahead of a planned public offering.

Citadel Joins the Table

Citadel, the U.S. hedge fund giant, is also expected to participate, joining existing holders like BlackRock and Abu Dhabi’s Mubadala. That lineup signals serious institutional conviction in Telegram’s long-term value — both as a platform and as a potential public equity.

Telegram Preps for IPO Window

The bond raise is being widely read as a pre-IPO move, echoing a pattern Telegram has followed before. The terms mirror its previous private funding round, where bondholders were offered discounted entry to a future listing. With markets stabilizing and investor risk appetite returning, Telegram appears to be timing the window.

The company hasn’t made a public comment yet. But with names like BlackRock and Citadel committing capital, Telegram doesn’t need to say much. The money’s doing the talking. Whether the IPO follows this year or next, the structure of this bond deal shows how the company plans to get there.

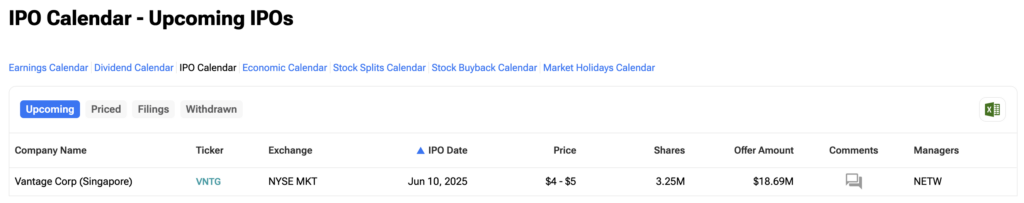

For investors looking to stay ahead of the market’s next big listings, TipRanks offers a live IPO calendar that highlights upcoming deals, pricing ranges, and key data points. From Vantage Corp’s $18.69M NYSE listing to high-profile tech debuts, the calendar helps traders and institutions stay in sync with the new issue pipeline.