Teladoc Health, Inc. (NYSE: TDOC) has reported mixed results for the second quarter of 2022. Following the results, shares of the company tanked 24.1% in Wednesday’s extended trade. The downside was triggered after the company took a significant non-cash goodwill impairment charge again.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Impairment charges are costs that reflect a decline in the carrying value of any particular asset on a balance sheet.

The company had taken a $6.6 billion or $41.11 per share impairment charge in the first quarter of 2022. According to Teladoc, the decision was taken based on the falling TDOC share price.

The Chief Financial Officer of Teladoc Health, Mala Murthy, said, “The goodwill impairment was triggered by the decline in Teladoc Health share price with the valuation and size of the impairment charge, primarily driven by an increased discount rate and decreased market multiples for a relevant peer group of high-growth digital health care companies.”

Consequently, Teladoc reported a net loss of $3.10 billion, or $19.22 per share, in the second quarter of 2022. The company had posted a loss of $133.8 million, or 86 cents per share, in the year-ago quarter. Analysts had expected the company to report a net loss of 61 cents per share in the June quarter.

Revenues of the telehealth company rose 18% year-over-year to $592.4 million in the second quarter of 2022. Access fees revenue climbed 20% year-over-year to $518.7 million. Visit fee revenue jumped 7% from the year-ago quarter to $66.7 million.

U.S. Revenues came in at $521.4 million, up 18% year-over-year, and International revenues soared 13% to $71 million.

Adjusted gross margin expanded 110 basis points year-over-year to 69.2% in the second quarter of 2022.

The average revenue per U.S. paid member rose to $2.60 in the reported quarter, up from $2.31 in the year-ago quarter.

Meanwhile, TDOC projects total revenues of $600-$620 million and adjusted EBITDA in the range of $35-$45 million for the third quarter of 2022. Net loss per share is expected between 60 and 85 cents.

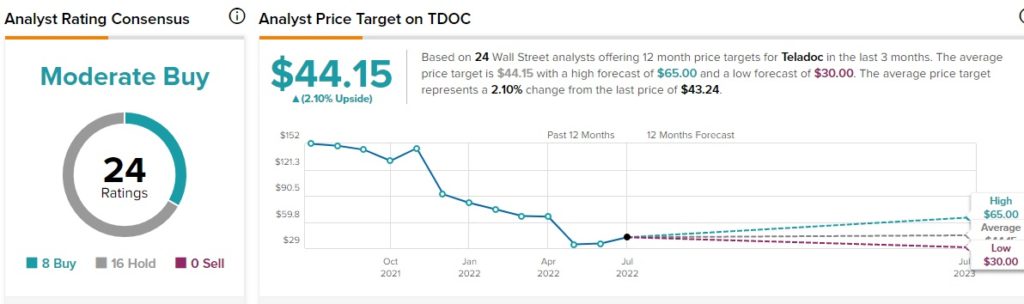

Street Is Cautiously Optimistic about TDOC Stock

According to TipRanks, the Street is cautiously optimistic about TDOC stock and has a Moderate Buy consensus rating based on eight Buys and 16 Holds. Teladoc’s average price forecast of $44.15 implies 2.1% upside potential. Shares of the company have declined 54.5% so far this year.

TipRanks data shows that financial bloggers are 76% Bullish on TDOC, compared to the sector average of 71%.

Concluding Thoughts

Teladoc Health is struggling with macroeconomic uncertainties, current trends in the direct-to-consumer and chronic care marketplaces, and adverse impacts of currency movements. As of now, a wait-and-watch strategy is expected to be beneficial for investors seeking exposure to the stock.

Read full Disclosure