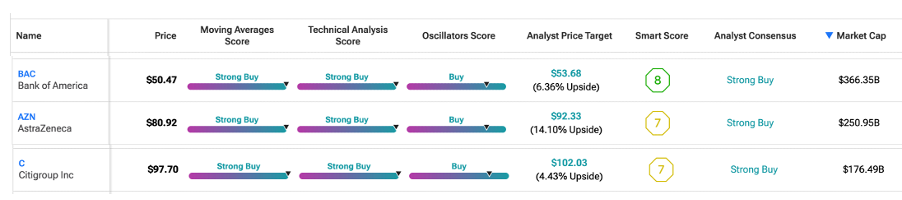

As markets remain shaky, technical analysis helps investors find good stock opportunities. Using TipRanks’ Technical Analysis Screener, we have identified three stocks, Bank of America (BAC), AstraZeneca (AZN), and Citigroup (C), that are currently flashing Strong Buy signals. These stocks are showing bullish momentum and present short- to mid-term upside potential, backed by Strong Buy ratings from Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, technical analysis studies a stock’s past price movements and trading volume to predict future trends. It uses tools like moving averages, RSI, and chart patterns to identify Buy or Sell signals. Within this context, TipRanks’ Technical Analysis tool simplifies this process by combining multiple indicators into one easy-to-understand dashboard for users. Let’s dive into the details.

Is Bank of America Stock a Good Buy Now?

Bank of America is among the largest U.S. financial institutions, offering banking, investment, and wealth management services worldwide.

According to TipRanks’ technical analysis, BAC stock is currently in an upward trend. It holds a Strong Buy rating based on both overall technical consensus and moving average indicators. One key indicator, the Rate of Change (ROC), which tracks momentum by measuring the percentage change in price over a set period, currently stands at 5.19 for BAC stock. Since an ROC above zero suggests upward momentum, this signals a Buy for the stock.

Is AstraZeneca a Good Stock to Buy Now?

AstraZeneca is a global biopharmaceutical company focused on discovering, developing, and commercializing prescription medicines.

According to TipRanks’ technical analysis, AstraZeneca’s stock stock holds a Strong Buy consensus. AZN stock also holds a Strong Buy rating based on moving average consensus, supported by 10 bullish and two bearish signals, indicating strong upward momentum.

Is Citigroup Stock a Good Buy?

Citigroup is a leading global financial services company offering banking, lending, wealth management, and investment solutions.

From a technical analysis perspective, Citi’s stock is rated a Strong Buy on overall consensus as well as moving average consensus. Additionally, C stock shows a positive ROC of 1.75, supporting a Buy signal and indicating strong upward momentum.