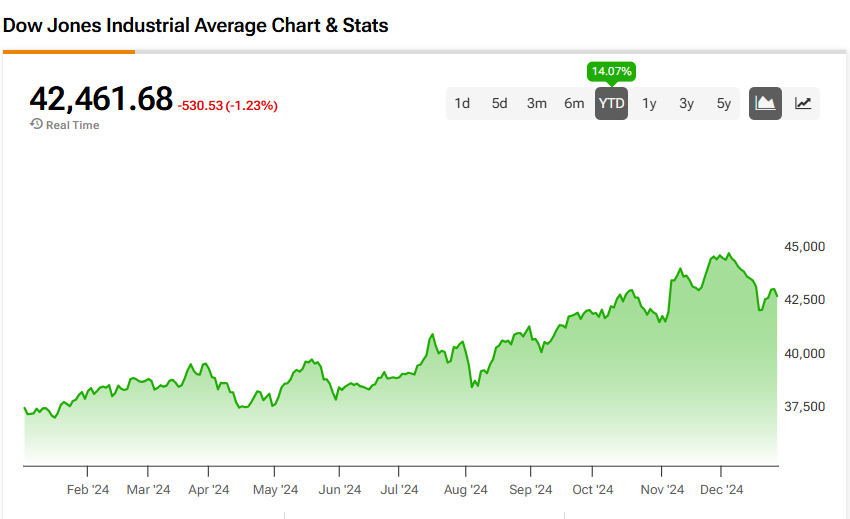

The Dow Jones Industrial Average (DJIA) is taking a beating on Monday, leaving investors worried about the index as the end of the year approaches. It’s been a rough time for the DJIA this year with the index suffering quite a bit over the last month. A large part of that was due to the December Federal Reserve meeting and talks of slowing interest rate cuts next year.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The big news hitting the Dow Jones today is a tech stock selloff. Many tech stocks fit into the growth stock category, which is strongly affected by interest rates. Higher interest rates are bad for them, meaning investors may be selling shares today ahead of the new year.

With this selloff comes a massive 1.23% decrease for the Dow Jones Industrial Average today. However, it is worth noting that the index is still up 14.07% since the start of the year.

Stocks Hitting the DJIA Index Today

Turning to the TipRanks heatmap tool, we can see which stocks are doing the most damage to the Dow Jones index on Monday. Frankly, there isn’t anything good going for the index. All of the stocks included in it are falling today. As noted above, tech stocks are leading today’s drop, but every sector is in the red right now.

How to Invest in the Dow Jones Industrial Average

Investors can’t take a direct stake in the Dow Jones as it’s only an index. Even so, they do have the option of acquiring shares in companies listed on it. Some investors might do so today as the dip could mark a solid entry point into these shares.

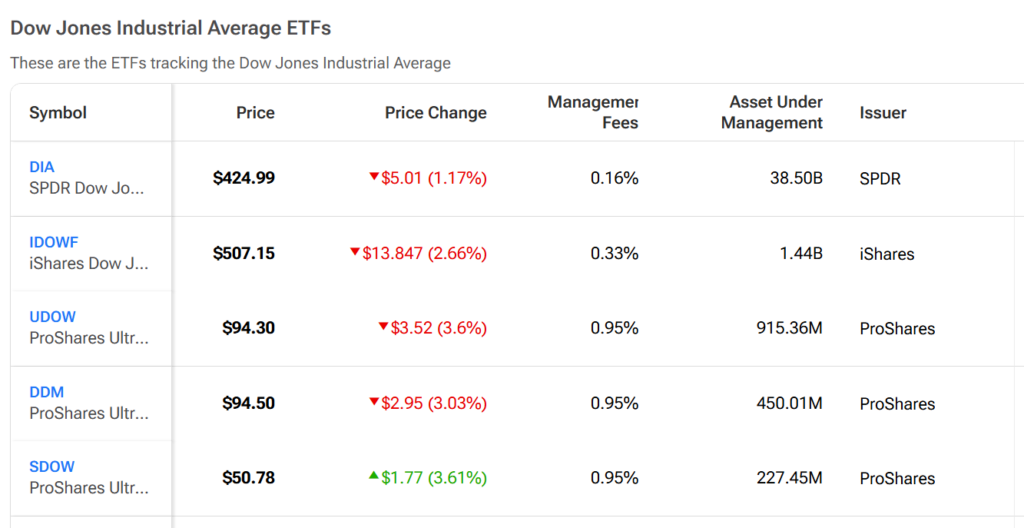

Another option is investing in exchange-traded funds (ETFs) that track the Dow Jones. Included are those betting on and against the index. One of the more popular examples is the SPDR Dow Jones Industrial Average ETF Trust (DIA), but many others are worth comparing in the chart below.