TD Bank (TD), Canada’s second-largest bank by market cap, is expecting a small windfall thanks to its investment in Texas-based Charles Schwab (SCHW). TD, which was one of the first Canadian banks to widely expand into the United States, owns about 10% of Schwab at last report.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In an October 16 press release, TD stated that the holding would likely generate C$207 million in gross equity income for the the fiscal 4th quarter. After deducting amortization of acquired intangibles of C$27 million, as well as C$2 million of acquisition-related charges, the net equity income from Schwab would amount to an estimated C$178 million.

TD shares have recently been on a downturn after it was revealed earlier this month that the bank would pay about USD $3 billion to settle allegations of money-laundering. Shares of the company’s NYSE listing have fallen more than 10% in the past week.

While news of the C$178 million income contribution from Schwab is definitely a positive, today’s news has failed to reverse the trend in TD stock. In early afternoon trading on Wednesday, shares of TD were slightly lower.

Do Analysts Rate TD Stock a Buy?

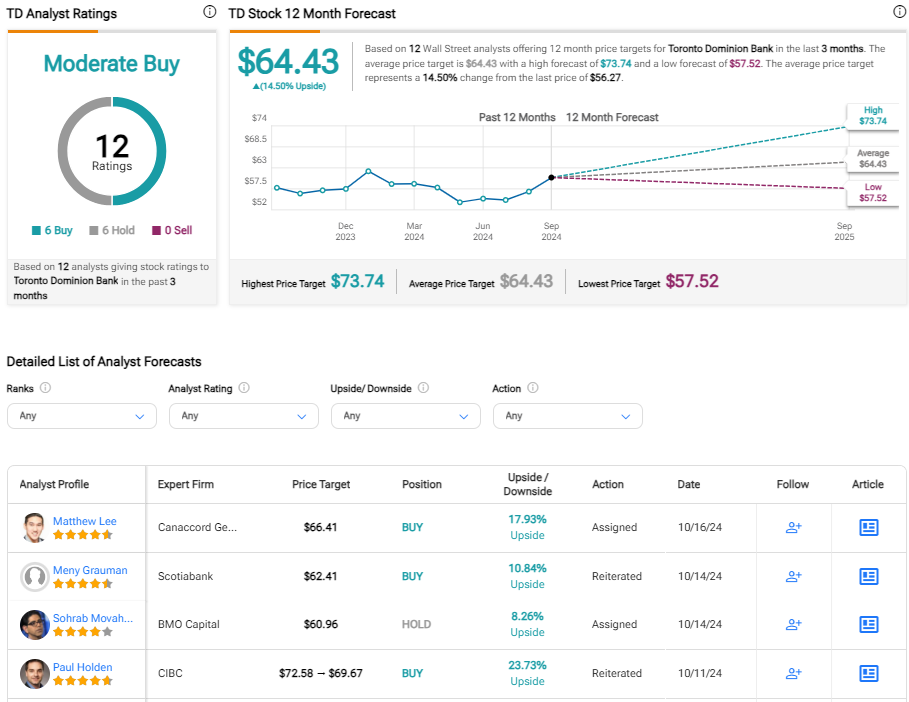

Based on 12 Wall Street analysts, TipRanks classifies TD Bank as a Moderate Buy. This is based on six Buy ratings and six Hold ratings offered by analysts in the past three months. The average TD stock price target is $64.43 for the NYSE-listed shares. This implies nearly 15% potential upside for the stock as compared to the recent market price.

TD is due to report its Q4 2024 financial results on December 5.