Volkswagen (VWAGY) shares skidded lower as the U.S. slapped tariffs on trading partners, but there are perhaps more pressing import tax matters for the company over in India.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The company is asking a Mumbai court to throw out an “impossibly enormous” tax demand of $1.4 billion, Reuters reported in an exclusive.

The case relates to rules around import taxation, which the company said could put its $1.5 billion investment in India at risk. If it loses VW could have to pay $2.8 billion with fines of up to 100% in cases like these.

Last year India slapped VW with the tax demand saying that the company evaded $1.4 billion in taxes by improperly declaring parts from the Audi, VW, and Skoda brands.

Authorities say VW avoided the usual 30-35% levy on imports of unassembled cars, known locally as Completely Knocked-Down (CKD) units, by declaring them as individual car parts, which attract taxes of between 5% and 15%. VW contends that it shipped parts separately and combined with some local components to assemble the vehicles in India.

Tax Claim Comes at Tricky Time for VW

The claim for the tax comes as VW negotiates a difficult period as the U.S. embarks on a tariff regime that will punish automakers.

Volkswagen, which has been producing vehicles in Mexico since 1967, is the most exposed to the 25% tariffs on goods exported from the country to the U.S.

VW makes 43% of its U.S. sales in Mexico, according to S&P Global Mobility, which notes that in 2024 about 15% of all U.S. light vehicle sales were made in Mexico.

However, due to the deep integration of supply chains it’s likely to lead to costs rising on more than just cars made in Mexico and sold in the U.S.

“Given the free flow of components across borders, the tariff would impact most vehicles produced in the US as well,” says S&P Global Mobility.

Is VW a Good Stock to Buy?

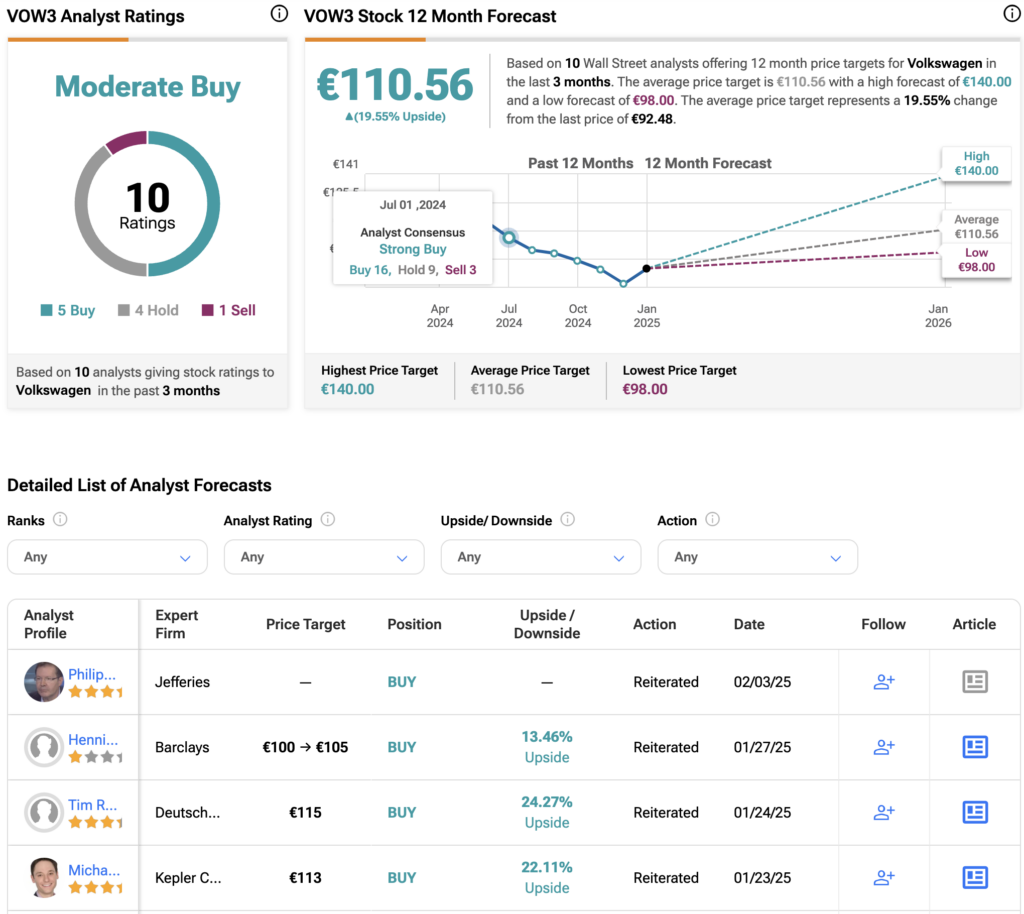

Turning the Frankfurt-listed stock, (DE:VOW3), analysts have a Moderate Buy rating on VW stock, based on five Buys, four Holds and one Sell. The average price target of €110.56 implies almost 20% upside from the current level.