Discount retailer Target (TGT) has announced that it’s cutting 1,800 corporate jobs as it restructures and tries to boost stagnant sales.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest job cuts represent the biggest round of layoffs at Target in a decade. The roles being eliminated are a combination of 1,000 layoffs and 800 positions that will not be filled. Together, they represent an 8% corporate workforce reduction, according to the company.

The job cuts are occurring as the Minneapolis, Minnesota-based retailer undergoes a leadership change. Target’s new CEO Michael Fiddelke is about to take the reins of the company. He was previously Target’s longtime chief operating officer and will replace current CEO Brian Cornell on Feb 1, 2026.

Sales Slump

The job cuts and restructuring come as Target grapples with a four-year sales slump. The company has been struggling with declining store traffic, inventory troubles, and customer backlashes since the Covid-19 pandemic.

Consequently, TGT stock has fallen 65% since hitting an all-time high in late 2021. Compared to competing retailers such as Walmart (WMT), Target draws less of its revenue from groceries and other necessities, which can make its business more vulnerable to economic cycles and consumer sentiment.

Is TGT Stock a Buy?

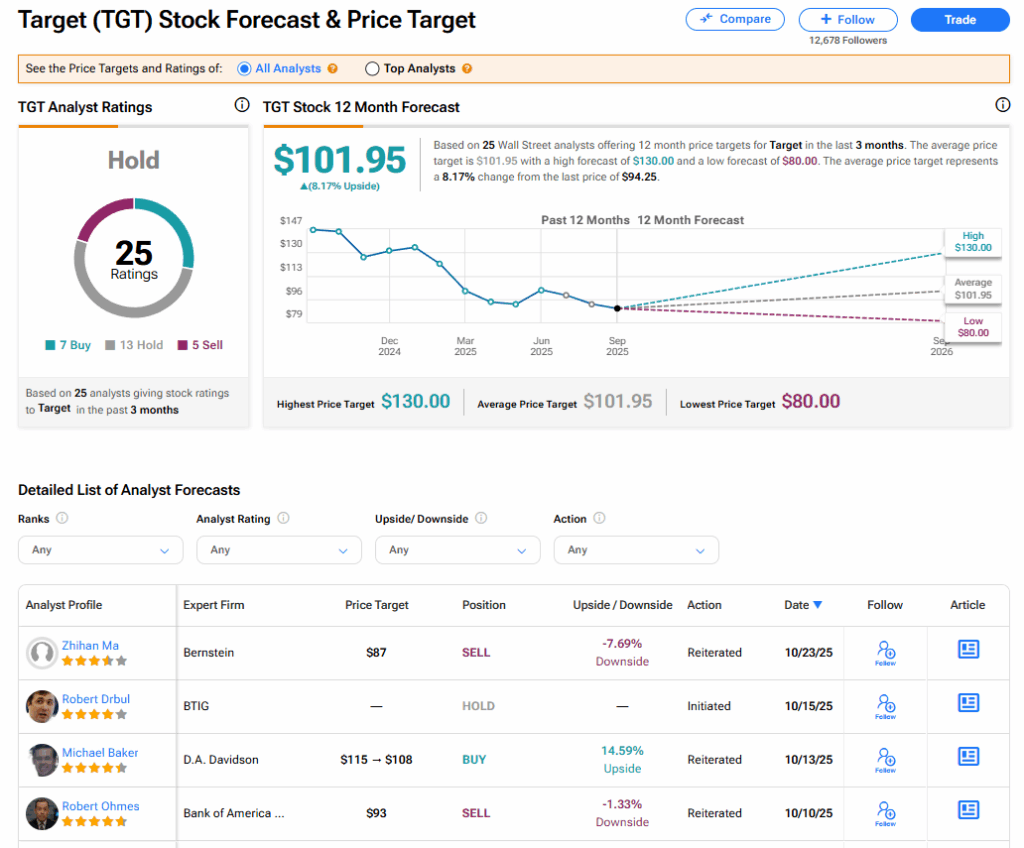

Target stock has a consensus Hold rating among 25 Wall Street analysts. That rating is based on seven Buy, 13 Hold, and five Sell recommendations issued in the last three months. The average TGT price target of $101.95 implies 8.17% upside from current levels.