Shares of Target (TGT) are rallying at the time of writing after the Financial Times reported that activist investor Toms Capital Investment Management had taken a significant stake in the retailer. As a result, investors appeared to welcome the possibility that outside pressure could lead to changes at the company. Although the exact size of the investment has not been disclosed, the news alone was enough to boost sentiment.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Unsurprisingly, this investment comes at a difficult time for Target, as it has seen 12 consecutive quarters of weak or flat sales growth. Meanwhile, the stock has fallen about 64% from its pandemic-era peak, when shoppers relied on Target as a convenient one-stop shop for essentials, clothing, and home goods. More recently, the slowdown has erased nearly a third of the company’s share value this year, which has left Target well behind the broader retail sector.

At the same time, Toms Capital has been increasingly active across the market. Founded in 2017 by former GLG Partners executives, the firm has recently taken positions in companies such as Kellanova (K), U.S. Steel, and Kenvue (KVUE), where it has pushed for strategic changes. Therefore, investors will be watching closely to see whether the activist’s involvement can help Target turn things around.

Is TGT Stock a Good Buy?

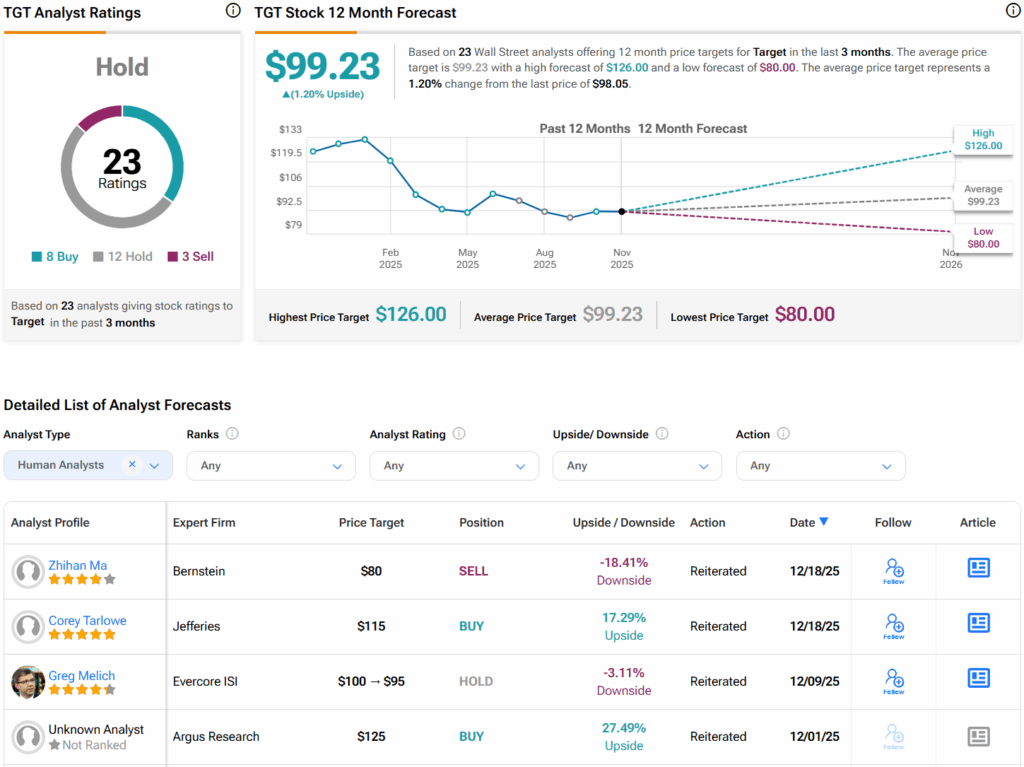

Turning to Wall Street, analysts have a Hold consensus rating on TGT stock based on eight Buys, 12 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TGT price target of $99.23 per share implies 1.2% upside potential.