Talos Energy (TALO), a pioneer in the exploration and production of oil, natural gas, and natural gas liquids, has successfully discovered commercial quantities of oil and gas at its Katmai West #2 well in the U.S. Gulf of Mexico’s Ewing Bank area. The exploration well, drilled under budget and ahead of schedule, encountered over 400 feet of gross hydrocarbon pay, promising excellent rock properties. The well is expected to produce 15,000 to 20,000 barrels of oil equivalent per day (BOE/day) once it commences operations later this year.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This successful exploration has nearly doubled the company’s proven estimated ultimate recovery of the Katmai West field to 50 million gross BOE, meeting the expected total of 100 million BOE in gross resource potential. Talos Energy also recently achieved record production, reduced debt by $100 million, and improved its 2024 production guidance, making it a compelling option for oil and gas investors.

Significant Proven Reserves

Talos Energy is a player in the exploration and production of oil, natural gas, and natural gas liquids and also participates in the development of carbon capture and sequestration. Recent production levels have reached 96.5 MBoe/d, primarily composed of oil and liquids.

Talos has successfully drilled the Katmai West #2 well in the Ewing Bank area of the U.S. Gulf of Mexico, encountering commercial quantities of oil and natural gas. The project was significantly under budget and completed ahead of schedule. The well was drilled to a depth of about 27,000 feet and hit its primary target sand full-to-base with over 400 feet of gross hydrocarbon pay, fulfilling pre-drill expectations.

Talos Is Aiming for 100 Million Barrels

The well’s expected deliverability matches estimates of 15-20 thousand barrels of oil equivalent daily (BOE/day). The success of this well and the previous Katmai West #1 well have almost doubled the estimated ultimate recovery (EUR) of the Katmai West field to approximately 50 million barrels of oil equivalent. It affirms the company’s expected total resource potential of roughly 100 million barrels of oil equivalent. The first production is scheduled for late Q2 2025.

Connection to the existing subsea infrastructure flowing to the expanded Tarantula facility means the well will be rate-constrained under the upgraded capacity, allowing extended flat-to-low decline production. Talos, as operator, holds a 50% working interest, with entities managed by Ridgewood Energy Corporation holding the remaining 50% in the Katmai West field.

The company also found commercial quantities of oil and natural gas at the Ewing Bank 953 well, with production expected to start by mid-2026. Talos Energy procured a 21.4% non-operated working interest in the Monument discovery located in Walker Ridge, Gulf of Mexico.

In addition, Talos-owned Brutus A3 well underwent re-completion, yielding a peak production rate of over 30 MMcf/d. The company also revised its 2024 production guidance, now expecting 91.0 – 94.0 Mboe/d.

Q3 Revenue Beat

In the third quarter of 2024, Talos Energy posted revenue of $509.3 million, exceeding analysts’ expectations by $7.14 million. The price of oil, natural gas liquids, and natural gas drove this. The net income for the quarter was $88.2 million, which translated to $0.49 net income per diluted share. Despite the robust earnings, the company posted an adjusted net loss of $25.6 million, or $0.14 adjusted net loss per diluted share.

The company’s adjusted EBITDA was $324.4 million. Capital expenditure for the period was $118.9 million, excluding plugging, abandonment, and settled decommissioning obligations. The quarter also saw net cash from operating activities reach $227 million and adjusted free cash flow at $121.5 million.

The company reduced its debt by $100 million during the period, bringing its leverage down to 0.9x.

Bullish Analyst Ratings

The stock has been range-bound for much of the past year, breaking out by climbing over 12% in the past three months. It trades near the middle of its 52-week price range of $8.89 – $14.67 and shows positive price momentum by trading above most of the major moving averages. The stock looks relatively undervalued based on its P/S ratio of 0.94x compared to the Energy sector average of 1.40x.

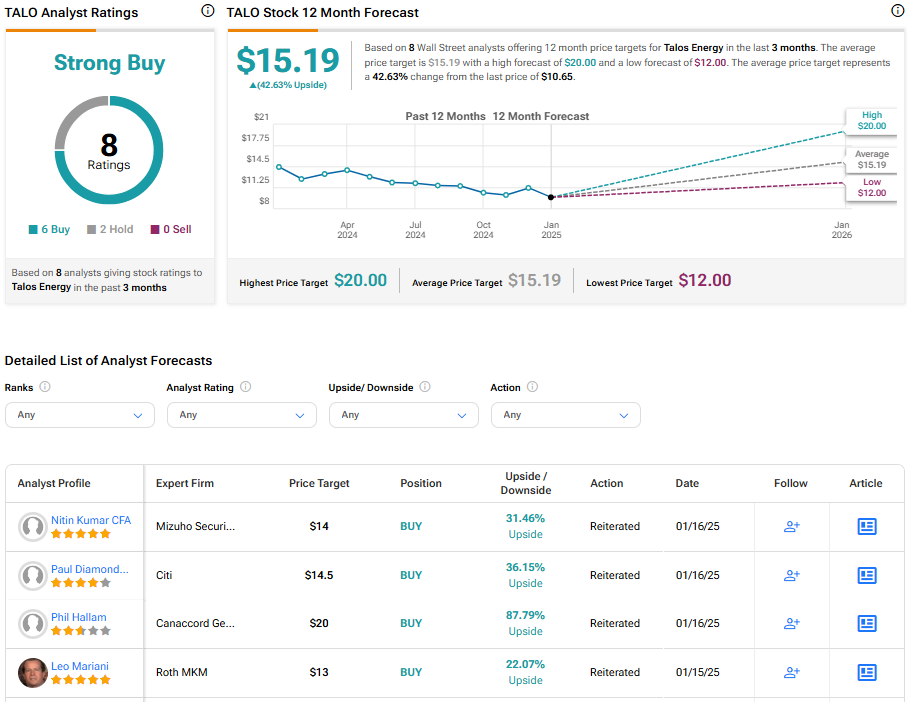

Analysts following the company have been bullish on TALO stock. Based on the recent recommendations of eight analysts, Talos Energy is rated a strong buy overall. Their average price target for TALO stock is $15.19, representing a potential upside of 42.63% from current levels.

Final Thoughts on Talos

Talos Energy is well-positioned for growth. The company has discovered significant commercial quantities of oil and gas in the prolific Ewing Bank area of the U.S. Gulf of Mexico. This venture, delivered under budget and on schedule, has significantly increased the company’s estimated ultimate recovery, further solidifying Talos’s position as an industry leader. The combination of robust operations, practical exploration projects, and strong financial performance makes Talos Energy a compelling prospect for investors looking into the oil and gas industry.