Addentax Group (ATXG) manufactures garments in China and the U.S. The company operates via four segments — Garment, Logistics Services, Epidemic Prevention Supplies, and Property Management and Subleasing. Let us take a look at the company’s financial performance and changes in its key risk factors that investors should know.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Addentax Group Risk Factors

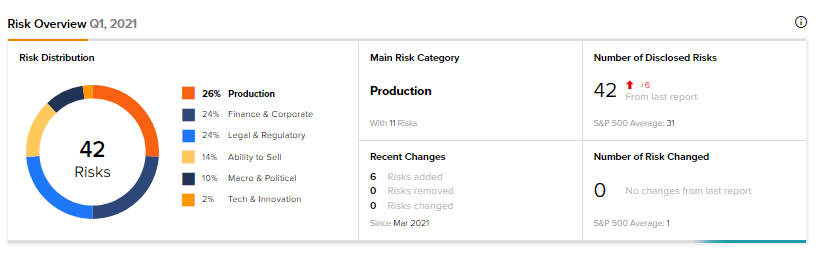

According to the new Tipranks Risk Factors tool, Addentax’s main risk category is Production, which accounts for 26% of the total 42 risks identified. The next two major risk factor contributors are Finance & Corporate and Legal & Regulatory at 24% each. Since March, the company has added six new risk factors under Finance & Corporate, Legal & Regulatory, Production and Ability to Sell.

Recent developments such as a joint statement by the SEC and the Public Company Accounting Oversight Board (PCAOB), NASDAQ’s proposed rule changes, and the Holding Foreign Companies Accountable Act all point to stricter criteria applied to companies from emerging markets in order to evaluate the non-U.S. auditors, who are not inspected by the PCAOB.

If Addentax is found to be non-compliant with these or future guidelines, trading of its shares on NASDAQ or other U.S. markets could be impaired or halted.

Addentax is heavily reliant on five suppliers for over 98% of its requirements. Any shortage or delay in supply can have a major impact on its business.

Epidemic Prevention Supplies is a new division of the company that contributed to an increase in topline during fiscal 2021. In the current COVID-19 scenario, prices and demand and supply dynamics of the required raw materials can be volatile, which can materially impact Addentax’s financial performance. This was the case during the first nine months of fiscal 2021 when, despite gaining higher revenue, Addentax incurred a loss on an order of nitrile gloves.

Another key risk factor is that Addentax generates a major part of its revenue from only a handful of customers. Hence, the loss of a major customer can adversely impact the company.

Financial Performance

In Fiscal Year 2021, Addentax’s revenue jumped 143.2% to $24.7 million on the back of higher garment sales and contribution from the newly set up Epidemic Prevention Supplies (EPS) segment. As much as 48.4% of this revenue came from EPS.

An increase in costs outpaced this growth in the top-line, which led to a net loss of $3.59 million versus a net loss of $980.6 thousand a year ago. (See Addentax stock chart on TipRanks)

Bottomline

The Production risk factor sector average stands at 20%, compared to Addentax’s 26.2%. This indicates that owning the stock is risky versus the broader sector.

Related News:

PepsiCo Earnings Preview: Here’s What To Watch for

WISH Receives Payment Institution License for E.U.; Street Remains Cautiously Optimistic

Knight-Swift Acquires AAA Cooper; Shares Jump 4%