Jefferies analyst Edison Lee upgraded Apple (AAPL) stock to Hold from Sell following its better-than-expected fiscal Q4 earnings. The five-star analyst also raised his price target to $246.99, up from $203.07, citing stronger-than-anticipated revenue and margin performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyst Sees Mixed Outlook

Lee noted that Apple’s September quarter revenue grew 8% year over year, beating both Jefferies and consensus estimates. While iPhone revenue growth was modest at 6%, other segments like Mac and iPad performed better than expected. Further, gross margin came in at 47.2%, slightly above forecasts, even after accounting for a $1.1 billion tariff impact.

Looking ahead, Apple guided for 10% to 12% revenue growth in the December quarter, which is 6% above consensus. However, Lee said that his forecast rose only slightly as he expects a $100 price hike for the iPhone 18 (meant to cover higher costs) might hurt sales and profit margins due to a weaker product mix.

Meanwhile, the analyst sees a strong start to Fiscal 2026 and potential upside from a rumored iPhone 18 Fold, which could help offset any downside.

What’s Ahead for AAPL?

Apple’s biggest hurdles in 2025 stem from rising component costs, slower iPhone volume growth, and global supply chain disruptions. Also, the tech giant faces tough competition, especially as rivals ramp up innovation in foldables, AI, and wearables.

Further, regulatory pressures and tariff uncertainty remain key concerns. Though Apple has shifted some production to India, recent U.S. tariffs targeting Indian imports have raised concerns about future cost structures.

Despite these headwinds, Apple’s long-term outlook seems encouraging. Its high-margin Services segment, spanning iCloud, App Store, Apple Music, and more, continues to grow rapidly and helps offset hardware volatility. Moreover, the rumored iPhone 18 Fold could be a game-changer, potentially leading to a new upgrade cycle.

Is AAPL Stock a Buy?

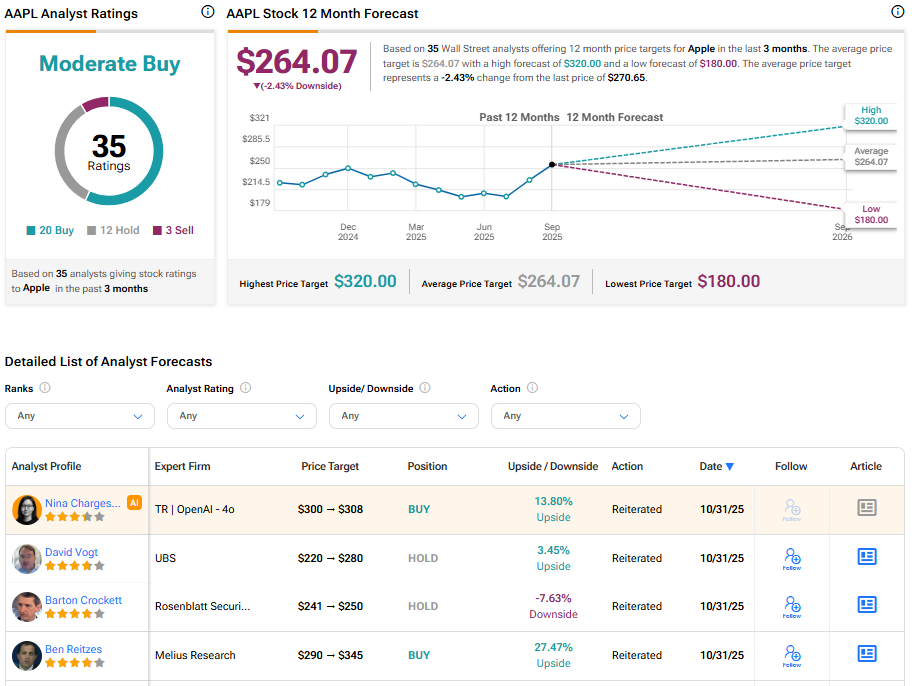

Turning to Wall Street, Apple stock has a Moderate Buy consensus rating based on 20 Buy, 12 Hold, and three Sell recommendations assigned in the last three months. The average AAPL price target of $264.07 implies 2.43% downside risk from current levels.