Taiwan Semiconductor Mfg. Co’s (NYSE: TSM) plans to raise its chip prices have been rejected by Apple (NASDAQ: AAPL). According to a report from Economic Daily News, a Chinese news outlet, Apple, one of TSMC’s largest customers and making up around 25% of its revenues, has rejected this plan.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The report said TSMC was planning to raise the price of the process for its 3 nm process by 3% which is largely used in Apple’s iMacs in the A17 chip.

According to a Nikkei Asia report earlier this year, it was reported that TSM could be planning to raise its chip prices next year in the range of 5% to 8%. The report cited inflation, COVID-related lockdowns in China, and Russia’s war on Ukraine as the reasons behind the price hike.

Is Taiwan Semiconductor a Good Stock to Buy?

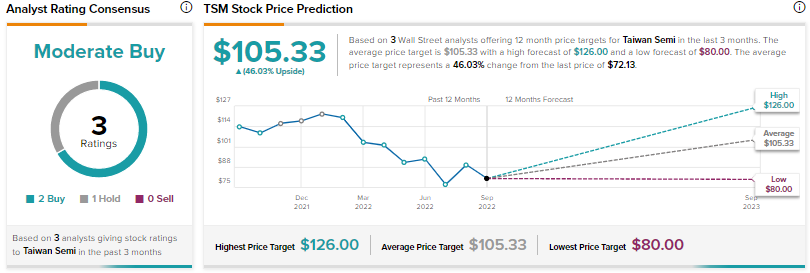

Analysts are cautiously optimistic about TSMC with a Moderate Buy consensus rating based on two Buys and one Hold.

The average price target for TSM stock is $105.33 implying an upside potential of 46%.