Taiwan’s government said today that China’s new limits on rare earth exports will not harm the island’s chip industry. The Ministry of Economic Affairs explained that the restricted materials differ from those used in semiconductor production. Most of the rare earths used in Taiwan come from Europe, the U.S., and Japan. This mix helps the island keep its chip supply chain stable. The ministry also said there is no need to worry about chip shortages at this time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Taiwan Semiconductor Manufacturing Company (TSM) produces most of the world’s advanced chips used in artificial intelligence. The company’s operations remain unaffected for now, even as trade pressure between Washington and Beijing grows.

Broader Supply Chain Faces Risk

However, the new Chinese rules may shake up global markets. China now requires exporters to seek government approval before shipping any product that contains more than 0.1% of certain rare earths. The move could cause slowdowns for industries that rely on these materials, such as electric vehicles and drones.

ASML Holding (ASML) may also face shipping delays because of the new review process. The Dutch company makes the tools used to produce the world’s most advanced chips. China controls about 70% of global rare earth mining and more than 90% of processing. This gives Beijing major influence over industries that depend on these elements.

U.S.–China Tensions Add to Market Pressure

The timing of China’s announcement has drawn attention. Presidents Donald Trump and Xi Jinping are expected to meet later this month during the Asia-Pacific Economic Cooperation summit in South Korea. The export curbs arrived just weeks before that event.

In reply, Trump announced new 100% tariffs on Chinese goods and warned that he could cancel the meeting. He called China’s move “hostile.” China said its controls were based on national security concerns and argued that the U.S. enforces more export restrictions than China does. Taiwan’s officials said they will continue to monitor the situation, as the controls could still affect sectors beyond chips.

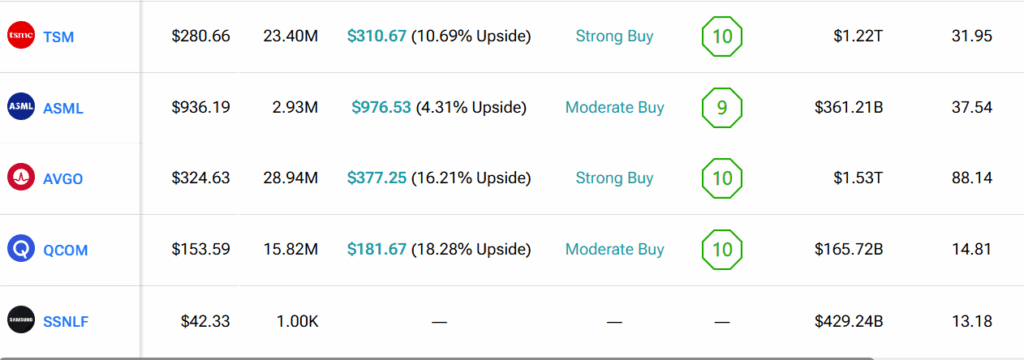

Using TipRanks’ Comparison Tool, we’ve lined up the most vulnerable companies to rare earth minerals, which could be affected by China’s new policy. This is a great tool to gain a broader examination of each stock and the chip industry as a whole.