Tabula Rasa HealthCare delivered better-than-expected sales in the fourth quarter as the patient medication safety solutions provider saw an increase in demand for its products and services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tabula Rasa HealthCare (TRHC) posted a GAAP net loss per share (EPS) of $1.36 during the fourth quarter, which was higher than the net loss per share of $0.33 in the comparable year-ago period.

Revenues increased 5% year-on-year to $77.1 million, topping analysts’ estimates of $74.9 million. The increase was attributable to a 16% gain in product sales and 5% inorganic growth from the Personica acquisition (October 2020).

For fiscal 2020, the company generated sales of $297.2 million, up from the $284.7 million posted in 2019. Diluted loss per share came in at $3.71, versus $1.57 in the comparable year-ago period.

Tabula Rasa HealthCare Chairman, Founder and CEO Calvin H. Knowlton, PhD said, “While the ongoing pandemic has created short term headwinds, it has also elevated the critical role pharmacists play in the broader healthcare ecosystem. We are uniquely positioned to capitalize on the growing market opportunity for our medication risk mitigation science and solutions over the next decade.”

Looking ahead to 1Q, Tabula Rasa HealthCare expects revenues to land between $75 million to $77 million and adjusted EBITDA of $3 million to $4 million.

For fiscal 2021, it estimates revenues to be between $336 million to $356 million and adjusted EBITDA to be between $26 million and $32 million. (See Tabula Rasa stock analysis on TipRanks)

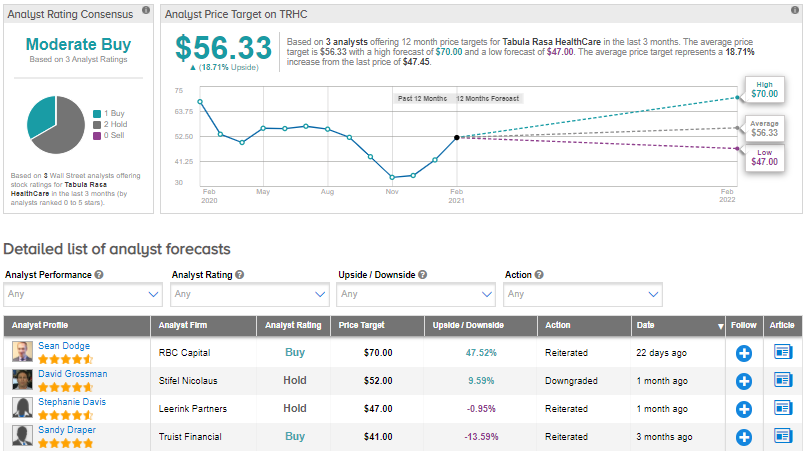

On Feb. 2, RBC Capital analyst Sean Dodge raised Tabula Rasa’s price target to $70 (47.5% upside potential) from $54 and reiterated a Buy rating. Dodge said, “The management has already positively pre announced the quarter, increasing his confidence that the underlying business is exiting the year on an encouraging trajectory.”

The rest of the Street has a Moderate Buy consensus rating on the stock based on 1 Buy and 2 Holds. The average analyst price target of $56.33 implies about 18.7% upside potential from current levels.

Related News:

ZoomInfo Spikes 12% As 4Q Profit Tops Analysts’ Estimates; Street Says Buy

PAVmed Tanks 12% After-Hours On Lucid Diagnostics Spin-Off

Five9 4Q Pops 10% Pre-Market On Blowout Quarter