T-Mobile (NASDAQ:TMUS) shares are under pressure today after the mobile communications services provider’s fourth-quarter EPS of $1.67 lagged estimates by $0.24. On the other hand, its revenue of $20.48 billion fared better than expectations by nearly $800 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, TMUS saw 299,000 postpaid net account additions and 1.6 million postpaid net customer additions. Postpaid churn stood at 0.96% in Q4. Further, the company added 53,000 prepaid net customers. Prepaid churn for the quarter came in at 2.86%. Notably, TMUS increased its number of high-speed internet customers to 4.8 million with 541,000 net additions in Q4. The company’s total number of customer connections now stands at a record 119.7 million.

These metrics helped the company increase its total Q4 service revenue by 3% year-over-year to $16 billion, while its net income jumped by 36% year-over-year to $2 billion. Impressively, its adjusted free cash flow rose by 77% to $13.6 billion for the full year.

For Fiscal Year 2024, the company expects 5 million to 5.5 million postpaid net customer additions. Core adjusted EBITDA for the year is seen landing between $31.3 billion and $31.9 billion. Further, adjusted free cash flow is anticipated to be in the range of $16.3 billion to $16.9 billion in 2024.

What Is the Target Price for TMUS?

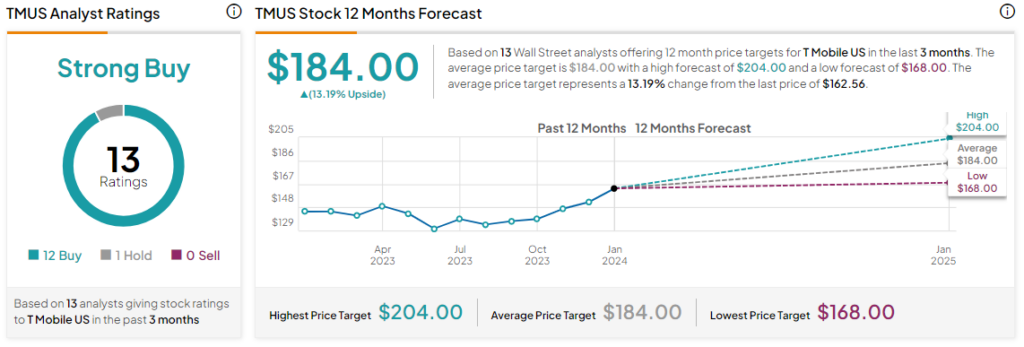

Overall, the Street has a Strong Buy consensus rating on T-Mobile, and the average TMUS price target of $184 implies a modest 13.2% potential upside in the stock. That’s on top of a nearly 14% jump in the company’s share price over the past six months.

Read full Disclosure