Shares of telecommunication giant T-Mobile (NASDAQ:TMUS) gained in pre-market trading on Wednesday after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $1.82 in the third quarter, a jump of 355% year-over-year, which beat analysts’ consensus estimate of $1.70 per share.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Sales declined by 1.2% year-over-year to $19.3 billion in line with analysts’ expectations of $19.34 billion.

The company also announced a quarterly dividend of $0.65 per share for the first time in the company’s history that will be paid on December 15, 2023. In the third quarter, T-Mobile bought back stock worth $2.7 billion. The company’s adjusted Free Cash Flows (FCF) hit $4 billion at the end of Q3, a jump of 94% year-over-year.

T-Mobile had postpaid net account additions of 386,000 in the third quarter with net customer additions of 1.2 million. The postpaid phone churn hit a new low of 0.87% in Q3.

Looking forward, management raised its FY23 guidance with postpaid net customer additions expected to be between 5.7 million and 5.9 million, as compared to its prior guidance in the range of 5.6 million to 5.9 million. Core Adjusted EBITDA, which is Adjusted EBITDA less lease revenues, is projected to be between $29 billion and $29.2 billion in FY23, an increase from its prior guidance in the range of $28.9 billion to $29.2 billion.

What is the Price Target for TMUS?

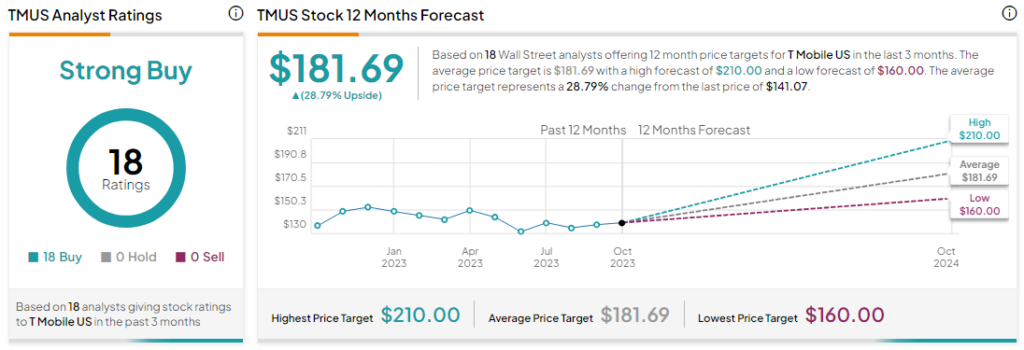

Overall, Wall Street analysts are bullish about TMUS stock with a Strong Buy consensus rating based on a unanimous 18 Buys. The average TMUS price target is $181.69 implying an upside potential of 28.8% at current levels.