AT&T (T) stock gained about 4% in the pre-market trading session today after the telecommunication giant beat Wall Street’s Q1 revenue expectations. The topline benefited from higher-than-expected subscriber growth in its cellphone plans amid economic concerns.

Q1 revenue rose 2% year-over-year to $30.6 billion and exceeded the consensus estimate of $30.4 billion. Meanwhile, the company reported adjusted earnings of $0.51 per share, which matched analyst predictions, but compared favorably with $0.48 per share in the year-ago quarter.

AT&T’s Q1 Subscribers Grow More-than-Expected

Moving to its subscriber growth, AT&T added 324,000 postpaid phone subscribers in Q1, beating the expected 255,000. This growth was aided by the strategic bundling of 5G and fiber internet plans, as well as discounted premium packages, which attracted more customers. Also, the company’s postpaid phone churn rate remained low at 0.83%.

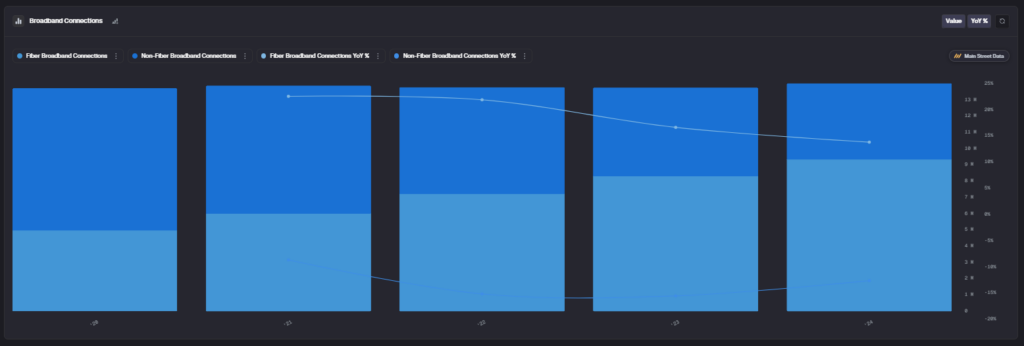

In its fiber broadband unit, AT&T added 261,000 net subscribers, marking its 21st consecutive quarter with over 200,000 net additions. The shift in consumer preference toward high-speed fiber connectivity and AT&T’s competitive offerings helped boost its growth.

According to Main Street Data, this shift in preference to high-speed fiber connections is evident. In the past five years, fiber broadband connections rose to 9.33 million in 2024 from 4.95 million in 2020. At the same time, non-fiber broadband connections fell to 4.66 million last year, compared with 8.74 million in 2020.

AT&T Reiterates FY25 Outlook

Looking ahead, AT&T has reiterated its full-year 2025 guidance. Service revenue is expected to grow in the low-single-digit range, with mobility service revenue likely to rise at the higher end of 2%-3%. Also, the company anticipates its consumer fiber broadband sales will increase in the mid-teens, reflecting strong demand for high-speed internet.

Further, AT&T continues to expect adjusted EPS in the range between $1.97 and $2.07. Moreover, the company expects the sale of its entire 70% stake in DIRECTV to TPG to close in mid-2025.

On the capital deployment front, AT&T disclosed plans to begin share repurchases in Q2, after having achieved a net leverage target of about 2.5 times net debt-to-adjusted EBITDA.

Is AT&T a Buy, Hold, or Sell?

Analysts remain bullish about T stock, with a Strong Buy consensus rating based on 17 Buys and four Holds. Over the past year, the stock has increased by about 72%, and the average T price target of $28.92 implies an upside potential of 7.27% from current levels. These analyst ratings are likely to change following AT&T’s results today.