Synopsys (NASDAQ:SNPS) stock hit a new 52-week high of $557 yesterday after the company delivered better-than-expected fiscal fourth quarter results. It is a software company that develops electronic products and software applications in the electronic design automation (EDA) industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SNPS’ quarterly performance benefitted from a strong demand for artificial intelligence (AI) compatible chips.

Q4 Snapshot

Synopsys’ top line increased 25% year over year to $1.6 billion, marginally beating the Street’s estimate of $1.59 billion. At the same time, its earnings of $3.17 per share handily exceeded analysts’ EPS expectations of $3.04.

SNPS witnessed growth in all three segments. Design Automation revenues increased 10.6% year-over-year to $953.7 million, Design IP sales jumped 74%, and Software Integrity revenues grew 3.6%.

Based on strong business momentum, Synopsys provided upbeat guidance for the first quarter of Fiscal Year 2024. It expects full-year revenues to be in the range of $1.63 billion to $1.66 billion, compared with analysts’ estimates of $1.58 billion.

Moreover, SNPS expects adjusted earnings to be between $3.40 and $3.45 per share, above the Street’s expectations of $3.05 per share.

Is SNPS a Good Buy?

Synopsys stock has surged over 72% year-to-date, buoyed by its dominant position in AI chip design solutions. Furthermore, the increasing adoption of Synopsys.ai, a portfolio of EDA development tools, by semiconductor manufacturers provides a solid case for the company’s future growth.

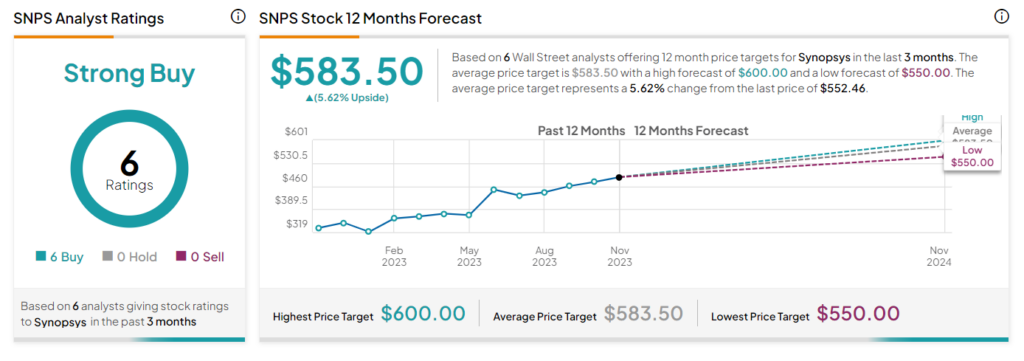

Wall Street analysts are highly optimistic about Synopsys. It has a Strong Buy consensus rating based on six unanimous Buys. The average SNPS stock price target of $583.50 implies 5.6% upside potential.