China’s State Administration for Market Regulation (SAMR) has given conditional approval to the long-pending merger between electronic design automation firm Synopsys (SNPS) and simulation software company Ansys (ANSS). The $35 billion merger had been halted because China delayed approval amid the heated U.S.-China trade war. The deal had already received approval from the U.S., the UK, and the European Union.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

China approved the merger following the easing of trade relations between the two nations, removing a major regulatory hurdle for the Synopsys-Ansys deal. Following the news, shares of both companies are trending higher in pre-market trading at the time of writing. SNPS stock is up 4.2%, while ANSS stock is rising by 5.7%.

What Are the Conditions for the Synopsys-Ansys Merger?

The combined company will have to abide by the conditions set by SAMR in order to proceed with the merger. Synopsys cannot terminate its existing customer contracts or deny renewal of contracts to Chinese clients. The regulator also requires the company to honor ongoing contracts under the existing pricing and service terms, as well as continue supplying EDA products to Chinese customers on fair and impartial terms. Additionally, the company will have to maintain interoperability agreements and renew them upon customer request.

Easing U.S.-China Trade Tensions

As part of the recent trade deal with China, Washington lifted its ban on the export of chip-software technology to the country. In response, China eased its restrictions on the export of rare metals to the U.S. Notably, EDA and software stocks have been rising steadily since the end of June, after the U.S. announced that it will sign a new trade deal with China. SNPS stock has gained more than 18%, and ANSS stock has surged nearly 12%.

Following the deal, the U.S. lifted the ban on export of chip-design solutions to China on July 3. The news was a significant positive for EDA firms, including Synopsys, Cadence Design Systems (CDNS), and Siemens AG (SIEGY). According to a report by Morgan Stanley (MS), these three companies together controlled almost 82% of China’s EDA market share in 2024 and thus play a vital part in designing semiconductors used in smartphones, automobiles, and electric vehicles (EVs).

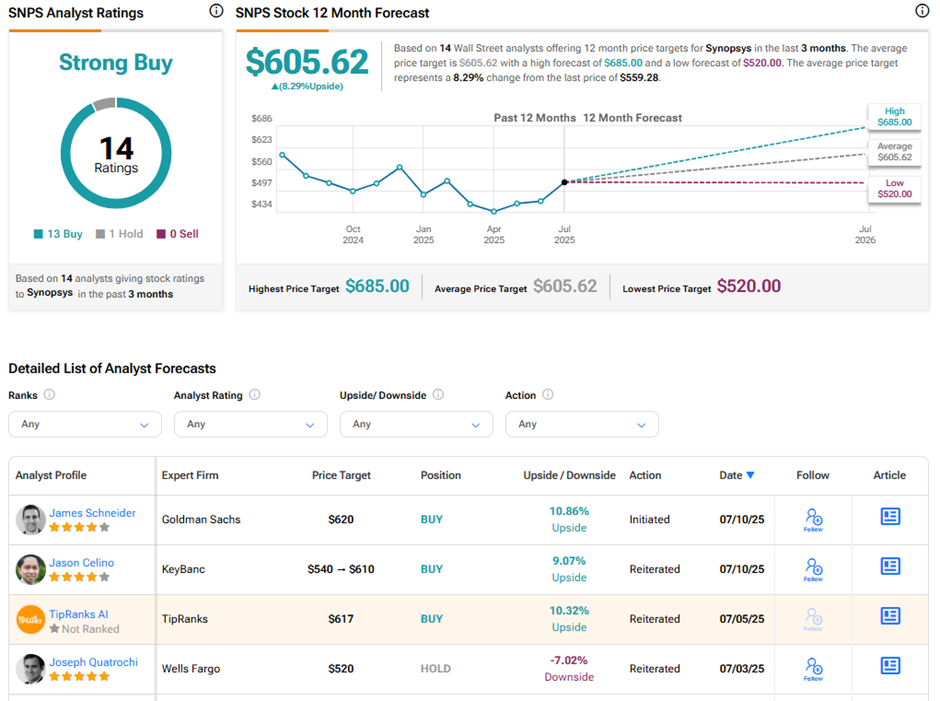

Is Synopsys a Strong Buy?

On TipRanks, SNPS stock has a Strong Buy consensus rating based on 13 Buys and one Hold rating. The average Synopsys price target of $605.62 implies 8.3% upside potential from current levels. Year-to-date, SNPS stock has gained 15.2%.