Is healthcare stock Syneos Health (NASDAQ:SYNH) planning a sale to private equity interests? The latest word from Dealreporter suggests that’s the case and that there are a growing number of firms coming in to take a shot at buying Syneos outright. The news was more than enough to draw investor attention, as Syneos is up over 10% at the time of writing.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The aforementioned reports note that, right now, four different parties—and possibly more to come—are all interested in picking up Syneos. The talks have reached the second round, and all four groups are still in the hunt. One party includes the coalition effort of Veritas Capital and Elliot Management. Both KKR (NYSE:KKR) and Apollo Global (NYSE:APO) are also in the hunt, though they’ll be bidding separately. Another has Thomas H. Lee, Centerbridge, and Advent International going in together.

This isn’t the first time we’ve heard of such an effort, either; Syneos has called in both Centerview Partners and Bank of America (NYSE:BAC) to help out in getting the sale to go through. Given the sheer number of interested parties, though, making a sale will likely not be difficult. However, Word from CEO Michelle Keefe somewhat explains why a sale may be in the offing. Keefe noted the company had “work to do” as far as getting its win rates up. Especially when compared to other small drug companies. But Keefe also noted that Syneos was “underweight” in terms of contracts.

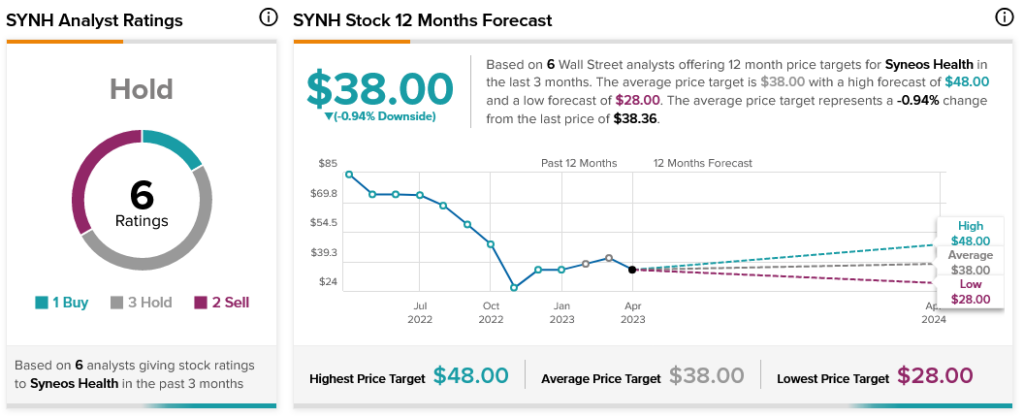

Analysts are somewhat split on Syneos Health stock in general. Currently, analyst consensus calls it a Hold based on one Buy, three Holds, and two Sells. In addition, its average price target of $38 suggests the stock is fully valued.