Global financial messaging giant SWIFT is teaming up with more than 30 of the world’s largest banks to overhaul the way cross-border payments move. The plan centers on a blockchain-based shared ledger that will make international transactions faster, cheaper and compatible with emerging forms of digital money.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SWIFT Moves to Reinvent Cross-Border Payments

SWIFT is one of the most entrenched pieces of financial plumbing, moving trillions of dollars daily across 200 countries. The system has long been criticized for being slow and costly, with payments often taking days to settle. By adding blockchain functionality, SWIFT is betting it can modernize without losing the compliance and security features that banks still demand.

The initial goal is to enable 24/7 real-time settlement of cross-border payments. If successful, the change could cut significant costs while also removing friction for businesses and consumers who depend on remittances, trade or global supply chain payments.

Banks Collaborate to Build the Shared Ledger

More than 30 institutions are working on the project, including JPMorgan (JPM), HSBC (HSBC), Deutsche Bank (DB), MUFG (MUFG), BNP Paribas (BNPQY), Santander (SAN) and OCBC (OVCHF), along with lenders from the Middle East and Africa. The shared digital ledger will act as a secure log of transactions between banks, validating transfers in real time and enforcing rules through smart contracts.

Pilot projects have already explored interoperability with stablecoins, tokenized deposits and central bank digital currencies. The plan is to expand those pilots into a system that runs across the whole SWIFT network. It would connect today’s banking system with new digital money.

Digital Currencies Create Urgency

The move comes at a time when money itself is changing. Stablecoins are no longer niche. Citi (C) recently projected circulation could climb to $4 trillion by 2030, supporting $100 trillion of annual trade. At the same time, about 90% of central banks are developing digital versions of their currencies.

The landscape is changing quickly, and this raises the stakes for SWIFT. Critics have described the network as “antiquated.” If SWIFT does not evolve, it risks losing relevance to nimbler blockchain-native platforms.

Ripple Creates Competitive Pressure

Ripple has long pitched itself as the faster and cheaper alternative to SWIFT for cross-border payments. Using its XRP (XRP-USD) token as a bridge asset, RippleNet already settles transactions in seconds and has built corridors with banks and remittance firms in Asia, Latin America and the Middle East.

Ripple and SWIFT take different approaches. Ripple operates through a crypto-native ledger, while SWIFT relies on its established bank network. Yet the competition has pressured SWIFT to modernize. The shared ledger initiative looks like a direct response to Ripple’s growing footprint.

For banks, the choice is evident. They can adopt Ripple’s system, embrace SWIFT’s blockchain upgrade, or experiment with both. In practice, interoperability between SWIFT’s ledger and RippleNet may eventually be critical, especially if institutions want to move money seamlessly across both systems.

Banking Industry Faces Broader Market Shift

The broader banking industry faces an uncomfortable choice: adapt or fall behind. A blockchain-based SWIFT ledger could offer a compromise, giving banks the compliance guardrails they need while still tapping into the efficiency and programmability of digital assets.

For banks, a functioning shared ledger could eventually extend to securities settlement, trade finance and cross-border lending. This possibility explains why major institutions are willing to commit resources early, even without a set timeline for launch.

How Should Investors View This?

For investors, the SWIFT overhaul is another sign that blockchain is moving from the fringes of crypto into the heart of global finance. If successful, the project could cement the role of tokenized money, whether stablecoins, CBDCs or deposits, in mainstream transactions.

The change may take years, but the trajectory is clear. Global payments are shifting toward faster, programmable and digital-native systems.

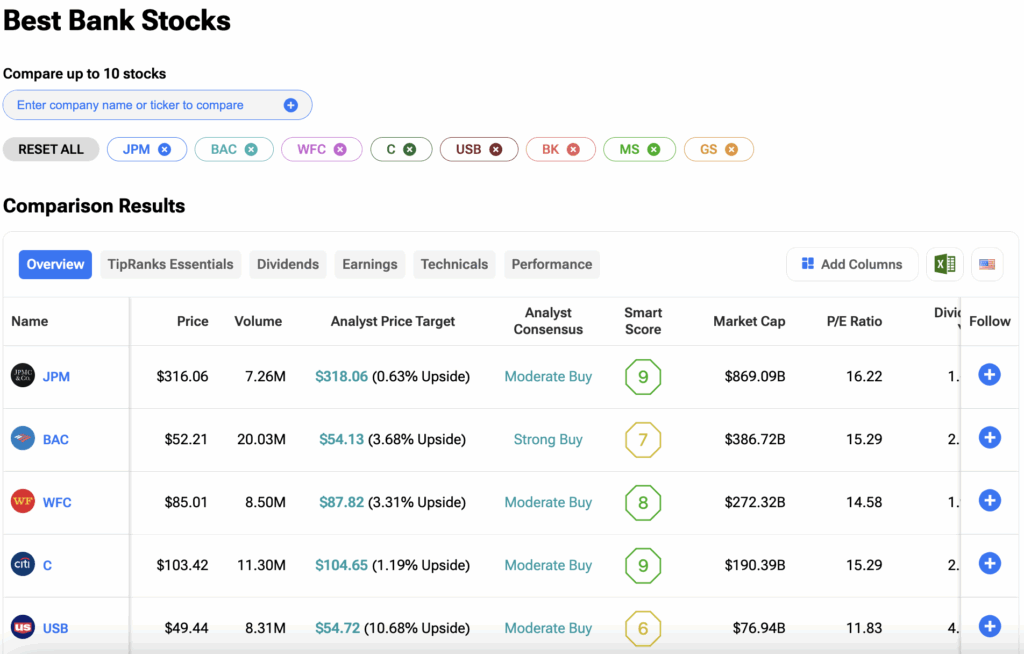

Investors can compare Banking stocks side-by-side based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to explore the tool.