Shares of U.S.-based AI server manufacturer Super Micro Computer (SMCI) led a rally in the S&P 500 (SPY) on Monday, as semiconductor stocks attempted a comeback following a tariff-driven selloff. Supermicro and other AI stocks ended higher, beating the broader market in a choppy session. SMCI jumped 10.6%, while chipmaker Nvidia (NVDA) climbed 3.5%. Broadcom (AVGO), known for its chip design, gained 5.4%, and AI software firm Palantir (PLTR) rose more than 5%.

Super Micro Computer delivers high-performance server and storage systems, focusing on energy-efficient, AI-optimized infrastructure.

Is Supermicro Stock Still a Cheap Buy?

Despite a volatile year, the company led the S&P 500 index in February after its robust Q2 guidance. It also narrowly avoided a potential Nasdaq delisting by meeting its audit deadline on February 25, resolving weeks of investor concern. As of now, SMCI shares are up 8% year-to-date.

Amid market volatility, SMCI stock has become significantly undervalued. It trades at just 0.74 times its expected sales, well below the sector median of 2.29. This low price-to-sales ratio suggests the market may be underestimating the company’s revenue potential, making SMCI attractive to investors.

Looking ahead, Supermicro forecasts revenue between $23.5 billion and $25 billion for fiscal year 2025, with the potential to hit $40 billion by FY26. This marks a sharp increase from the $14.9 billion reported in FY24, highlighting the company’s aggressive growth outlook.

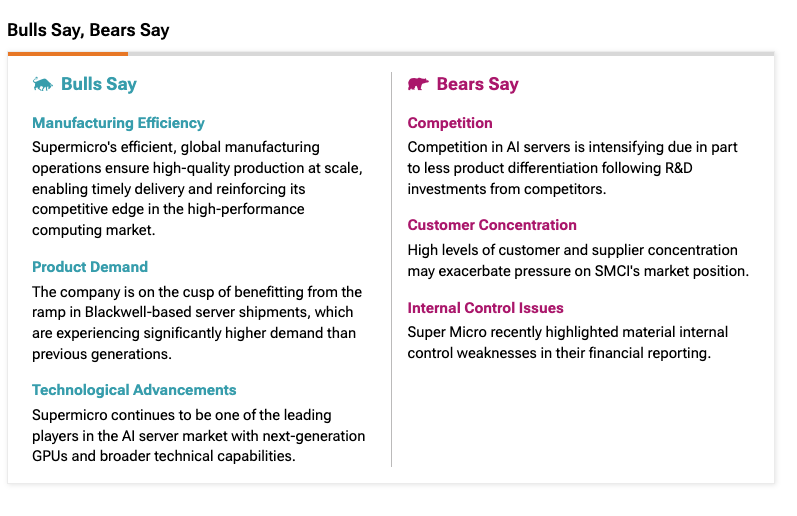

Insights from TipRanks’ Bulls Say, Bears Say

TipRanks’ “Bulls Say, Bears Say” tool provides insights into analysts’ perspectives on SMCI stock.

Analysts remain optimistic about SMCI due to its strong manufacturing efficiency, which supports scalable, high-quality production and fast delivery. The company is also well-positioned to capitalize on soaring demand for next-gen Blackwell-based servers.

On the other hand, analysts remain cautious about competition in the AI server space, driven by rivals investing heavily in R&D. The company also faces challenges from high customer and supplier concentration, which could impact its stability. Additionally, recent disclosures of material weaknesses in internal financial controls have raised governance concerns.

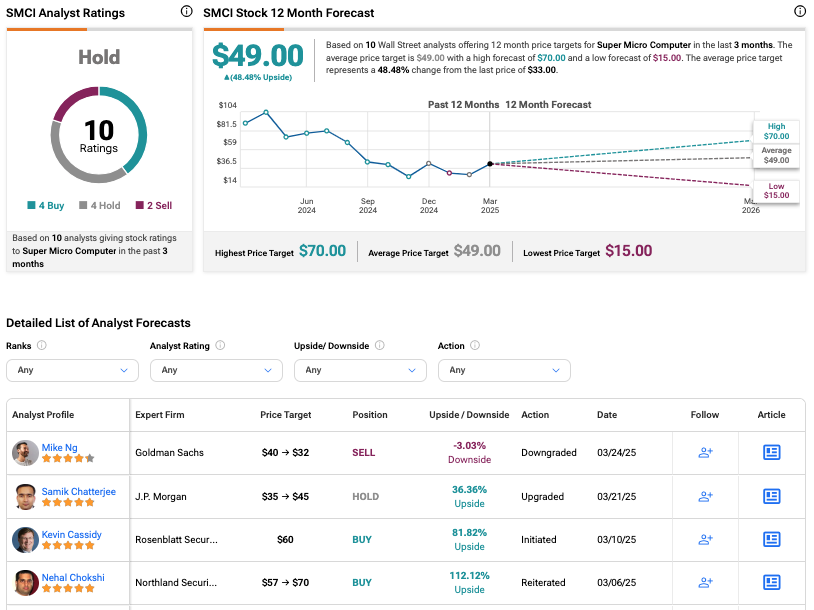

What Is the SMCI Target Price?

On TipRanks, SMCI stock has a Hold consensus rating based on four Buys, four Holds, and two Sell ratings. Also, the average Super Micro Computer price target of $49 implies a 48.5% upside potential from current levels.