Shares of Super Micro Computer (SMCI) fell about 7% Thursday morning after the company reported preliminary fiscal Q1 revenue that missed both Wall Street expectations and its own guidance. The AI server and data center equipment maker said it expects Q1 revenue of $5 billion, well below its prior forecast of $6 billion to $7 billion and the analyst consensus of $6.49 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Shift, Not Demand Slowdown

The revised outlook is attributed to recent design win upgrades, essentially customers upgrading their server orders, exceeding $12 billion. This pushed some expected Q1 revenue into the second quarter.

Despite the move, Supermicro noted that customer demand remains robust, especially for its advanced GPU and server solutions. These include systems powered by Nvidia’s (NVDA) chips and AMD’s (AMD) processors, key components in AI workloads and data center expansion.

CEO Charles Liang said there is significant customer interest in their new AI liquid-cooled solutions. Also, he stated that the company’s key clients are “ramping large, multi-quarter, volume deployments,” which supports demand growth. Importantly, the company maintained the full-year revenue forecast of at least $33 billion.

While the company did not provide updated earnings figures, it confirmed that its Q1 earnings call is scheduled for November 4. Alongside earnings, SMCI will provide more details on Q2 deliveries and revenue.

Is SMCI a Good Stock to Buy?

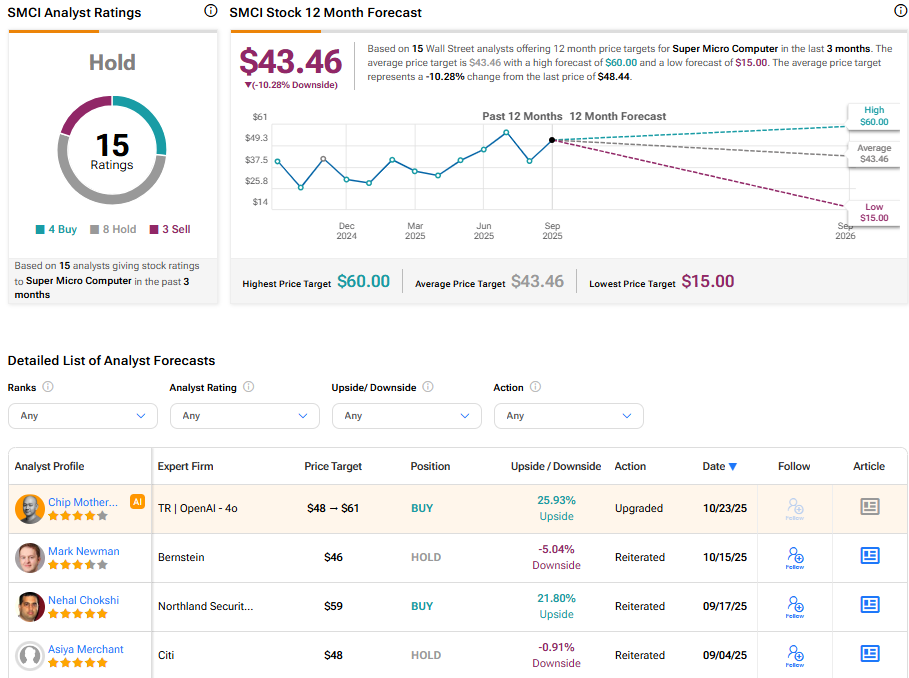

On TipRanks, SMCI stock has a Hold consensus rating based on four Buys, eight Holds, and three Sells assigned in the past three months. Meanwhile, the average Super Micro Computer price target of $43.46 implies a 10.28% downside risk from current levels.