Super Micro Computer (NASDAQ:SMCI) represents one of the stock market’s biggest success stories of the past year. Lugging its 12-month gains of 770%, the company has been a main beneficiary of the AI boom given it is a maker of advanced server and storage solutions designed to effectively handle the demanding tasks associated with AI applications like ChatGPT. And bonus points for Supermicro: it works closely with AI lord Nvidia, incorporating its chips into its hardware solutions.

Due to the big gains, questions have been raised around the stock’s valuation. However, given its positioning in the space, that is not a concern for Loop Capital analyst Ananda Baruah.

“We continue to gain confidence in both our net-bullish Gen AI server industry posture (L-T) and SMCI as an increasing leader in the need for both complexity and scale,” the 5-star analyst said. “We believe valuation (P/E) will remain a conversation point and believe if our fundamental thesis has teeth a 20x – 30x P/E is maintainable. More specifically, now that SMCI is in the S&P 500, we’re having regular conversations with large long-only’s (both holders and new to the name) expressing the view that 20x – 30x makes sense for a leader in a structural build-out dynamic such as Gen AI.”

Accordingly, Baruah rates SMCI a Buy, while raising his price target to a Street-high of $1500 (from $600), implying investors will be sitting on returns of 57% a year from now. (To watch Baruah’s track record, click here)

Baruah’s bullish outlook also applies to his near-term expectations. According to his research, Baruah reckons SMCI’s business “remains very healthy,” with the analyst expecting strong March quarter results and a robust guide for the June quarter. In fact, with that in mind, Baruah thinks it would not be much of a surprise for SMCI to offer a positive pre-announcement on the March quarter results.

The analyst sees the company delivering March quarter revenue “at the very least” in the range between $4.1 billion – $4.5 billion, up from the guided range of $3.7 billion – $4.1 billion and above the Street’s forecast of $4.0 billion.

As for the June quarter, here Baruah also takes a positive stance, believing that regardless of the March quarter’s results, SMCI appears to be in a “strong position” to guide for a sequential increase.

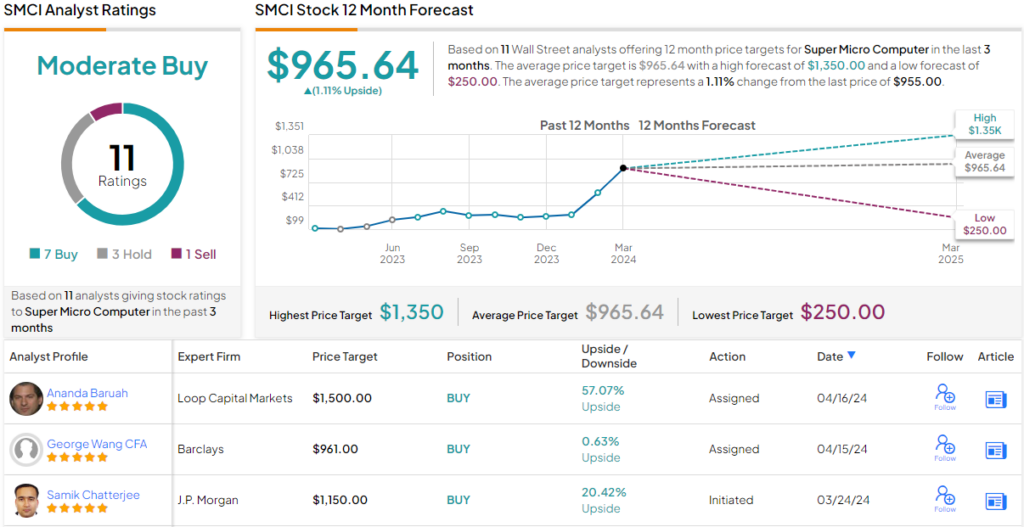

So, that’s the Street’s most bullish take on SMCI, but where do other analysts stand? Overall, the stock has 11 analyst ratings, split among 7 Buys, 3 Holds, and 1 Sell. This gives the stock a Moderate Buy from the analyst consensus. Shares are selling for $952.40, and the $965.64 average price target suggests shares will remain rangebound for the foreseeable future. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.