Super Micro Computer (SMCI) stock has demonstrated extreme volatility in recent months due to concerns about its financials and the potential for delisting from the Nasdaq (NDAQ) exchange. However, I believe these concerns are largely overplayed. As such, I’m bullish on Super Micro Computer stock. Long-term tailwinds in the data center segment and room for error within the stock’s valuation should playout favorably for the company.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Super Micro Computer’s Uncertainties

As an investor in Super Micro Computer, I’m cautiously optimistic about the stock, although I recognize the downside risks. While the audit and delisting risks are serious, I believe there’s a good chance they’ve been overstated. The appointment of BDO USA as the company’s new independent auditor is a significant step forward. The auditor wouldn’t have taken the job without an initial review of Super Micro Computer’s finances, suggesting that the picture might not be that bad.

Although not part of the Big Four accounting firms, BDO has the global capabilities necessary to handle Super Micro’s complex operations. This move, along with the submission of a compliance plan to Nasdaq, shows that SMCI is taking proactive steps to address its regulatory challenges. It’s also worth noting that Super Micro Computer has overcome similar hurdles before. The company was previously delisted in 2018 but managed to return to Nasdaq in 2020 and achieve a remarkable 3,000% increase in value since then.

Of course, I appreciate that there could be downside risk here if the issues really are insurmountable. The market doesn’t know the extent to which Super Micro Computer’s finances were erroneous. However, I remain optimistic that these risks have been overstated.

Super Micro’s Market is Huge

While uncertainties remain, particularly regarding potential restatements and the completion of delayed filings, I believe Super Micro Computer’s strong position in the booming market for artificial intelligence (AI) servers provides a solid foundation for recovery. This is largely why I’m bullish on SMCI stock.

According to Precedence Research, the global data center market was valued at $229.23 billion in 2023 and is forecast to expand at a 11.72% compound annual growth rate (CAGR) over the next decade, reaching $775.73 billion by 2034. This growth is driven by the increasing adoption of cloud computing, the rising need for data storage, and the growing reliance on data-intensive technologies such as AI and data analytics.

Moreover, as a provider of high-performance server solutions, Super Micro stands to benefit from the surge in demand for data center infrastructure, notably for AI. The company’s focus on scalable, energy-efficient products aligns with the needs of modern data centers, which require powerful, flexible, and cost-effective solutions to manage large volumes of data and support increasingly complex workloads.

Super Micro Computer’s Server Technology

Super Micro Computer’s unique selling proposition lies in its rapid time-to-market for new server technologies, often two to six months ahead of competitors. The company’s modular “building-block” approach allows for highly customizable solutions and the broadest product portfolio in the industry.

Additionally, Super Micro is a leader in liquid-cooled AI servers. These are server systems which can reduce data center power usage substantially — as liquid is a better conductor than air — potentially by as much as 40%. All this data makes me confident that the company will continue to thrive as the sector goes from strength-to-strength.

Super Micro’s Valuation

Another reason I’m bullish on this stock is Super Micro Computer’s valuation. The company doesn’t believe that it will need to restate its financial results from previous quarters, and I’m happy to take the valuation data as is, albeit with a small discount. As Wedbush analyst Matt Bryson, a five-star rated analyst on TipRanks, said, “Last time SMCI encountered accounting issues, changes were not material in our view with only small portions of revenue being reallocated between quarters (the larger issue being the delisting).”

There may be some concerns about its ability to maintain its sales outlook, however, this is more than covered by the discounted valuation. Current forecasts suggest the stock is trading at 11.7 times forward earnings — a 53.5% discount to the sector average — and with a price-to-earnings-to-growth (PEG) ratio of 0.31 — an 83.7% discount to the sector average.

The favorable valuation leaves room for error, especially considering Super Micro Computer’s PEG forward ratio, which suggests the stock is vastly undervalued based on growth projections. I appreciate that we may see some revisions to growth expectations, but, as noted, there is plenty of room within the current valuation for error.

Is Super Micro Computer Stock a Buy?

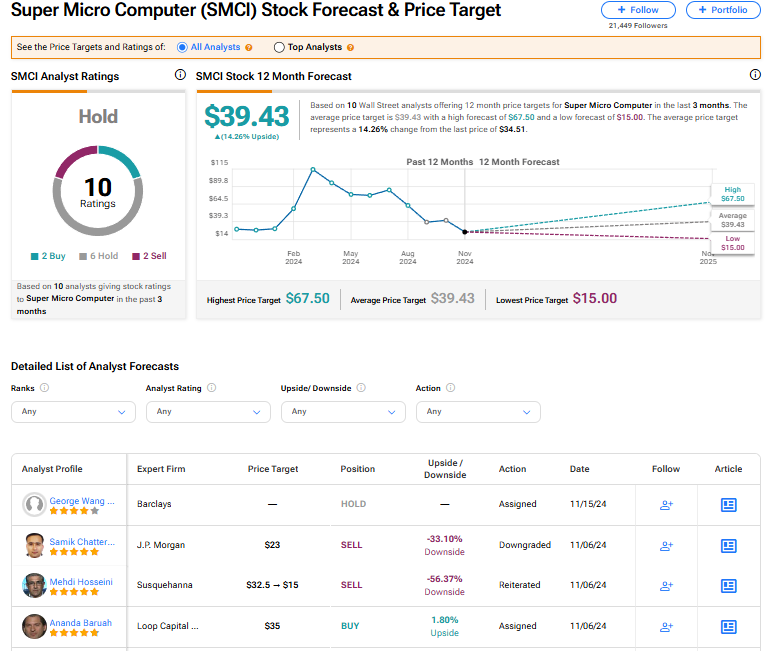

On TipRanks, SMCI has a consensus Hold rating based on two Buys, six Holds, and two Sell ratings assigned by analysts in the past three months. The average SMCI stock price target is $39.43, implying 3% upside potential.

Read more analyst ratings on SMCI stock

Conclusion

I am bullish on Super Micro Computer stock due to its strong fundamentals and growth potential in the booming AI server market. Despite recent volatility and concerns about financials, I believe these risks are overstated. The company’s proactive measures, including appointing a capable auditor and its innovative product offerings, position it well for recovery. With attractive valuation metrics providing room for error, I see significant upside potential as demand for data center solutions continues to surge.