Super Micro Computer (SMCI) stock rose 5.8% on Wednesday after the company announced the launch of a new optimized storage server that uses its Petascale architecture and is powered by Nvidia’s (NVDA) Grace CPU Superchip.

Super Micro Computer offers high-performance, energy-efficient server and storage solutions. It is one of the leading direct liquid cooling (DLC) technology providers for AI (artificial intelligence) data centers.

SMCI Innovates New Storage Server

Super Micro said that it developed the Petascale storage server using the NVIDIA Grace CPU with 144 Arm Neoverse V2 cores, which support high-performance software-defined storage workloads found in AI and ML (machine learning) training and inferencing, analytics, and enterprise storage.

SMCI said that the company closely worked with Nvidia to develop and test its storage server equipped with the Grace CPU Superchip, offering storage software providers a range of hardware choices to address different application requirements. The new storage server will help customers gain from Nvidia’s advanced CPU and DPU (data processing unit) offerings to accelerate networking protocols using less power compared to x86 servers.

Aside from Nvidia, SMCI is also collaborating with WEKA to develop its high-density storage server. WEKA is a leader in high-performance storage software for AI, high performance computing (HPC), and enterprise data management workloads.

Is SMCI Stock a Buy, Hold, or Sell?

Super Micro Computer is gradually regaining investor confidence, as the company recently met Nasdaq’s listing requirements by filing its delayed financial reports. Moreover, the announcements of the company’s AI solutions in collaboration with Nvidia have also boosted investor sentiment.

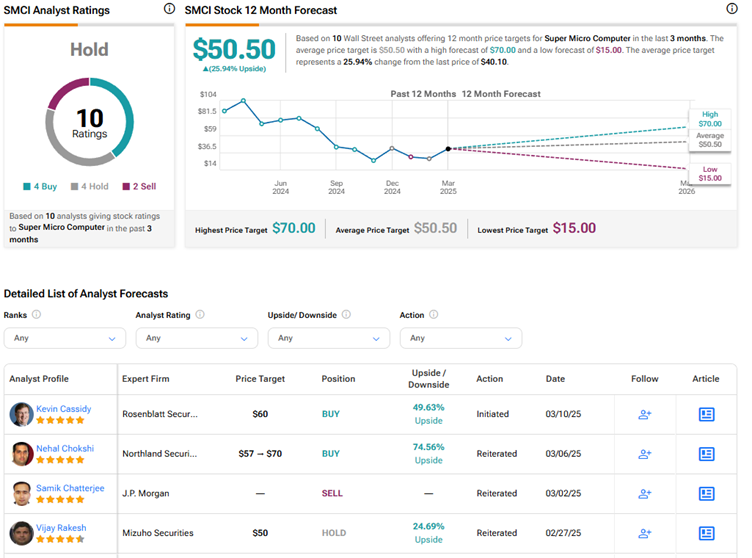

However, some analysts are concerned about the company’s weak outlook and ability to meet the ambitious target of achieving $40 billion in revenue by 2026. Wall Street is currently divided on SMCI stock, with a Hold consensus rating based on four Buys, four Holds, and two Sell recommendations. The average SMCI stock price target of $50.50 implies about 26% upside potential. SMCI stock has risen 32% so far this year.

Questions or Comments about the article? Write to editor@tipranks.com