As a proxy for spending on data center construction, Super Micro Computer (SMCI) provides real-time sentiment data on artificial intelligence. It’s easy for experts to wax lyrical about the broader implications of machine learning and related technologies. Ultimately, however, investors must finance these innovations — and it’s at this friction zone where SMCI stock is struggling.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Again, you could engage in flowery rhetoric about the paradigm-shifting potential of generative AI. Given the rapid investment and competition in the field, these assertions—even some of the ambitious blue-sky targets—will likely materialize somewhere on the horizon. However, the maintenance of capital inflows into AI cannot be assumed to occur linearly.

Even for a profound innovation like machine intelligence, investors view the sector as a give-and-take. Right now, they’re taking, and that has caused some pain in the AI-centric ecosystem. And because Super Micro Computer is downstream in the AI value chain—focusing on operations such as server assembly, rack-scale integration, and physical delivery and installation—the dirty work tends to roll downhill, so the saying goes.

While Super Micro’s structural positioning means that it’s at a disadvantage during AI-adjacent sell-offs, it’s also fair to point out that, in certain conditions, contrarian upswings can be pretty robust. In short, I believe that there’s going to be a reflexive dynamic in SMCI stock.

In the past half-year period, SMCI has lost 37% of its value. Obviously, investors have been taking. Eventually, though, the speculation is that they will view Super Micro as a discount. As the principle of reflexivity demonstrates, perception can become reality when reinforced through feedback loops. That’s the heart of the opportunity we may have now in SMCI stock.

Understanding SMCI Stock in a Three-Dimensional Context

Although a typical technical chart—where price is plotted as a function of time—is framed within a flat, two-dimensional paradigm, in reality every publicly traded security operates in a three-dimensional probability space. Options are no longer multi-dimensional; rather, because of the time and outcome constraints imposed, they penalize dimensional ignorance.

At the core, traders ask the following questions: how much (expected price value), how likely (probability density), and how frequently (dataset population traversing)? Because options operate in a multi-dimensional environment, Ashby’s Law of Requisite Variety essentially requires us to model assumptions within the same categorical paradigm.

Yes, we could look at flat price charts, but doing so would put us — not the market — at a deliberate disadvantage.

Over the last several months, I’ve been running a discretized, iterated quantitative model through a hierarchical framework. For more details on the mechanics of this system, readers can refer to my series of TipRanks articles. The purpose of my model is to reveal the behavioral structure of demand, a concept I call risk geometry.

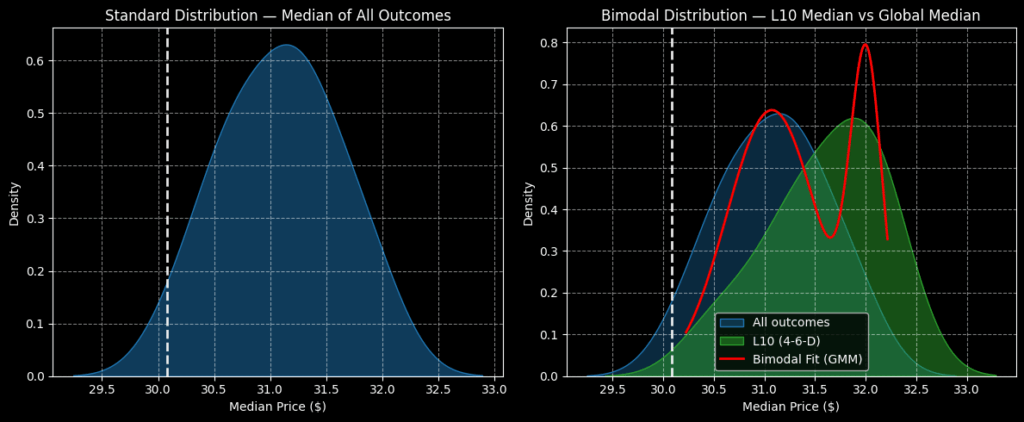

Using this approach, the forward 10-week returns for SMCI stock, based on a dataset that dates back to January 2019, are typically expected to range from $29.30 to $32.90 (assuming an anchor price of $30.08, Monday’s close). To be clear, this projection does not mean that SMCI is guaranteed to land within this distribution; just that this is the most likely distribution based on hundreds of rolling 10-week samples.

What makes the current setup different is that SMCI stock is structured in a 4-6-D sequence. In the last 10 weeks, SMCI printed only four up weeks, leading to an overall downward slope. Under these circumstances, the forward 10-week returns typically range between $29.50 and $33.40, with peak probability density materializing just shy of $32.

To reiterate, we’re not saying that this projected distribution will be set in stone. Obviously, the market may be influenced by exogenous factors that no one can predict. As such, the next outcome could land somewhere out of left field.

What we’re saying instead is that, based on the available data, $29.50 to $33.40 is the likely terminal destination over a fixed 10-week period.

Using Risk Topography to Narrow Down an Aggressive Trade

Although we have determined that it’s more probable — relatively speaking — for SMCI stock to terminate at $32 over the next 10 weeks, this price point isn’t guaranteed. My speculation is that SMCI moving forward could terminate higher, perhaps at $33.

Part of my reasoning centers on the colloquial interpretation of the phrase, reversion to the mean. In other words, I’m not looking for SMCI stock to revert to a literal, mathematical mean. Instead, I’m referring to the loose concept that the stock has struggled for long stretches of time. If good news starts to trickle into the AI ecosystem, SMCI could see a robust rebound.

Second and more importantly, I’m considering risk topography, a three-dimensional view of risk geometry. The quantitative data show that, although termination at $32 is likely, SMCI stock typically temporarily traverses price points above $32. Therefore, if we bought a vertical spread and capped the upside at the $32 strike price, we could incur an opportunity cost.

Instead, I want to go for it with a 31/33 bull call spread expiring Feb. 20, 2026. This transaction requires SMCI stock to rise through the second-leg strike at expiration, which is extremely ambitious. However, the maximum payout for this event occurring stands at over 153%.

Enticingly, the breakeven price sits at $31.79, which sits just south of peak probability density. While no guarantees can be made, the speculator might not lose money in this trade. Simultaneously, the $33 second leg allows traders to contend for maximal upside.

Is SMCI Stock a Buy, Sell, or Hold?

Turning to Wall Street, SMCI stock has a Hold consensus rating based on five Buys, five Holds, and two Sell ratings. The average SMCI price target is $46.82, implying ~60% upside potential in 2026.

SMCI Stock Set For Market Rebound

Although Super Micro Computer has struggled due to the fallout in the AI ecosystem, this underperformance is likely attributable to its structural disadvantage as a downstream value-chain participant. Nevertheless, both fundamental undercurrents and statistical data suggest that a reflexive rebound is possible for SMCI stock, making it an intriguing — albeit non-obvious — upside proposition.