AI hardware company Super Micro Computer (SMCI) has been making interesting moves lately. Indeed, it launched a new solution called Data Center Building Block Solutions (DCBBS), which has the goal of helping companies build liquid-cooled AI data centers more efficiently and at a lower cost. Interestingly, the company said that the DCBBS will be ready within three months and includes everything from advanced manufacturing to management software, on-site services, and global support.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Furthermore, CEO Charles Liang explained that DCBBS covers the full process of building an AI data center, like designing the layout, setting up the network, and installing backup power systems. According to Super Micro, this solution can help customers save up to 40% on power, reduce the size of the data center by 60%, and cut water use by 40%, which all adds up to a 20% reduction in total cost of ownership. Super Micro also offers extra services such as data center planning, system validation, and professional installation. In addition, for customers who need high uptime, the company offers fast, 4-hour on-site support.

Separately, it is also worth noting that earlier this week, Super Micro signed a $20 billion deal with DataVolt, a Saudi Arabian data center company, to speed up the delivery of powerful GPU servers and rack systems for its large AI data centers in Saudi Arabia and the U.S. The goal is to combine advanced server technology with clean energy sources like renewables and green hydrogen to create more sustainable data centers.

Is SMCI Stock a Good Buy?

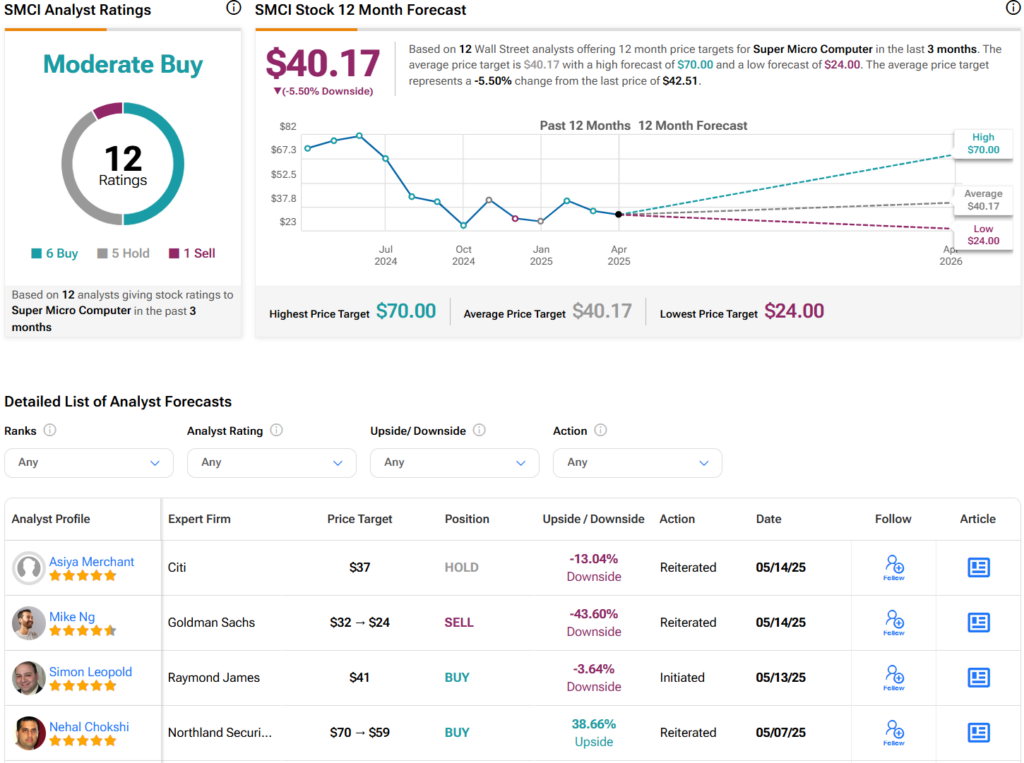

Turning to Wall Street, analysts have a Hold consensus rating on SMCI stock based on six Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average SMCI price target of $40.17 per share implies 5.5% downside risk.