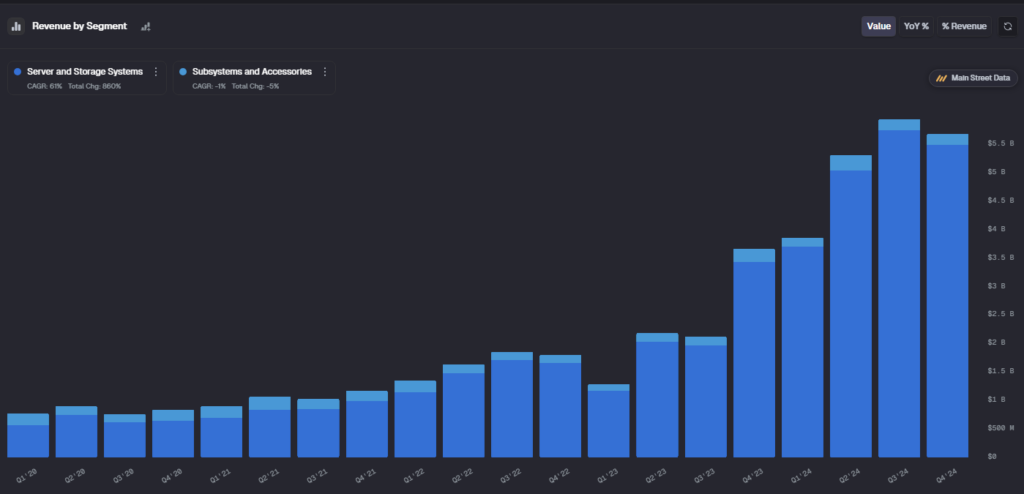

AI server maker Super Micro Computer (SMCI) is set to release its Q3 audited financials after the market closes on May 6. Wall Street analysts anticipate that the company will report earnings of $0.43 per share, reflecting a 35% year-over-year decrease. On the contrary, revenues are expected to rise by 31% from the same quarter last year, reaching $5.05 billion, according to data from the TipRanks Forecast page. Notably, shares of Super Micro have grown by over 5% year-to-date. Overall, analysts remain Hold on SMCI stock ahead of Q3 earnings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The upcoming earnings report follows a disappointing preliminary update last week, in which Super Micro cut its Q3 revenue and profit forecasts. The company now expects adjusted EPS between $0.29 and $0.31, and revenue in the range of $4.5 billion to $4.6 billion. The company said this revision was due to delayed customer decisions that pushed some Q3 sales into the next quarter. As a result, the stock dropped about 18% following the announcement on Wednesday.

According to Main Street Data, Super Micro reported $5.7 billion in revenue for the quarter ending December 2024. The sharp slowdown expected this quarter raises concerns about demand, execution, and whether the company can maintain its growth pace.

During the earnings call, investors will be keen to hear management’s comments on future plans, particularly regarding sales growth and any potential impact from the delayed customer decisions.

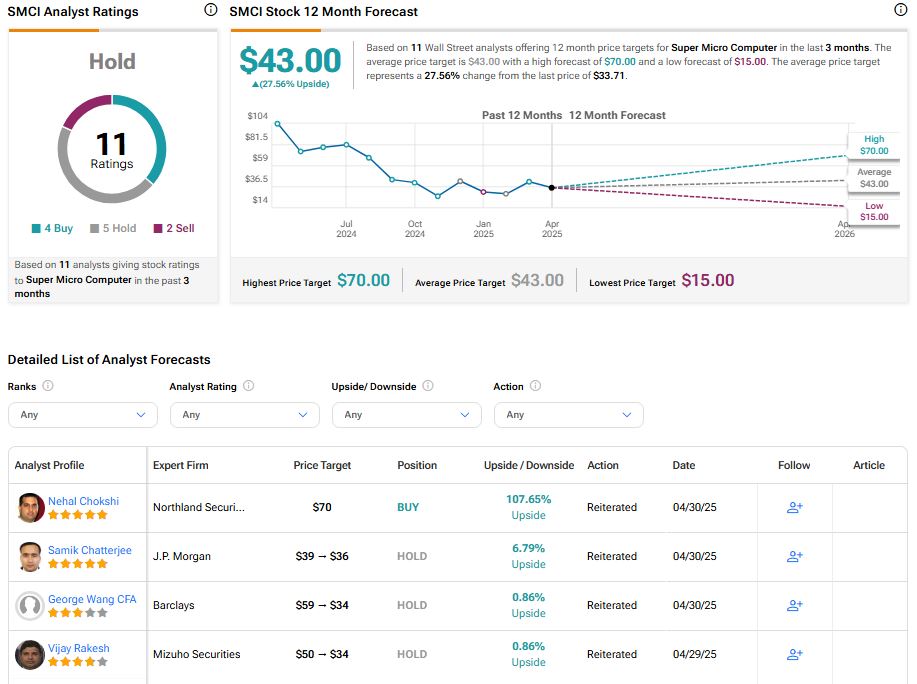

Analysts Lower Q3 Estimates and Price Targets for SMCI

Following the company’s preliminary third-quarter results, several Wall Street analysts have revised their price targets downward and reduced their revenue and earnings projections for Q3 and Fiscal 2025. Nehal Chokshi, an analyst at Northland Securities, maintained a Buy rating on SMCI stock but lowered his price target to $70. The analyst now expects the company to report earnings per share of $0.21 for the quarter, down from his earlier estimate of $0.38.

Similarly, Barclays analyst George Wang cut his price target for SMCI to $34 from $59 while keeping a Hold rating. He cited “too much uncertainty” surrounding AI server builds and a “lack of visibility into CY25” as customers undergo product transitions. In addition, J.P. Morgan analyst Samik Chatterjee reduced his price target for SMCI to $36 from $39 per share.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 12.16% move in either direction.

Is SMCI Stock a Buy?

The stock of Super Micro Computer has a consensus Hold rating among eleven Wall Street analysts. That rating is based on four Buys, five Holds, and two Sell recommendations issued in the past three months. The average SMCI price target of $43.00 implies an 27.56% upside risk from current levels.