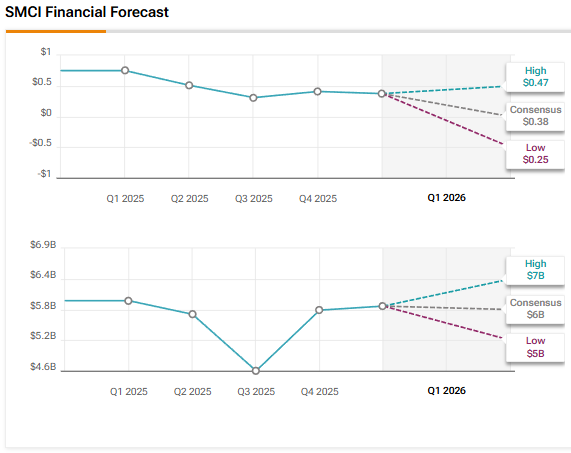

Artificial intelligence (AI) server maker Super Micro Computer (SMCI) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on Tuesday, November 4. SMCI stock took a hit recently after the company announced a weak preliminary Q1 revenue estimate of $5 billion, which was lower than its previous guidance and missed the Street’s expectations. Nonetheless, Super Micro stock is still up 70.5% year-to-date, as investors are confident about the company’s long-term growth prospects amid the AI boom. Meanwhile, Wall Street is cautious on SMCI stock and expects the company to report earnings per share (EPS) of $0.38 for Q1 FY26, reflecting a 49.3% year-over-year decline.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The consensus revenue estimate of $5.83 billion indicates a 1.9% decline from the prior-year quarter. Investors will look forward to management’s commentary on the momentum in SMCI’s business and new deals.

Analysts’ Views Ahead of SMCI’s Q1 FY26 Earnings

Following the Q1 update, Rosenblatt analyst Kevin Cassidy increased the price target for Super Micro Computer stock to $60 from $50 and reaffirmed a Buy rating. The 5-star analyst stated that the company’s negative pre-announcement of its Q1 FY26 revenue is disappointing, though offset by an announced backlog of over $12 billion of new designs, with deliveries requested in the fiscal second quarter. Cassidy pushed $1.5 billion of his Q1 FY26 revenue estimate into the out quarters for FY26. He raised his FY26 revenue estimate, though it remains slightly below management’s $33 billion forecast.

In Cassidy’s view, the AI data center market is moving very quickly, with customers requesting the leading-edge designs. The analyst believes that SMCI is “nimble enough” to react to customer requests despite the near-term revenue disruptions. “The net results being satisfied customers and locking in longer-term growth,” said Cassidy.

Meanwhile, Mizuho analyst Vijay Rakesh reiterated a Hold rating on SMCI stock with a price target of $50. The top-rated analyst noted SMCI’s commentary about $12 billion of design wins in the September quarter, which he believes are with customers looking to secure deliveries in the December quarter. This is pushing some of its Q1 FY26 revenue to the fiscal second quarter as demand for Nvidia’s (NVDA) GB300, B300, and RTX Pro remains strong, while Advanced Micro Devices’ (AMD) MI355X servers are also starting to ship, noted Rakesh.

Despite strong design wins, Rakesh remains sidelined on SMCI stock as he sees Dell Technologies (DELL) taking share in the Tier-2 CSP (cloud service provider) and Enterprise AI server markets with large ramps at Oracle’s (ORCL) OCI (Oracle Cloud Infrastructure), xAI, and CoreWeave (CRWV) while seeing advantages with financing and 10x services and support.

AI Analyst Is Cautious on Super Micro Stock Ahead of Q1 Print

Interestingly, TipRanks’ AI Analyst has assigned a Neutral rating to SMCI stock with a price target of $56, indicating about 8% upside potential. The AI analyst noted positives like SMCI’s strong revenue growth and improved cash flow, offset by contracting profitability margins, increased leverage, and valuation concerns.

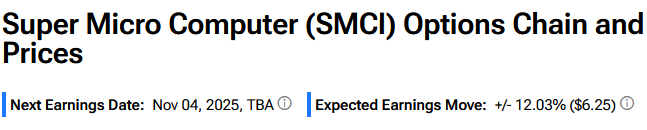

Options Traders Anticipate a Major Move on SMCI’s Q1 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 12.03% move in either direction in SMCI stock in reaction to Q1 FY26 results.

Is SMCI Stock a Strong Buy?

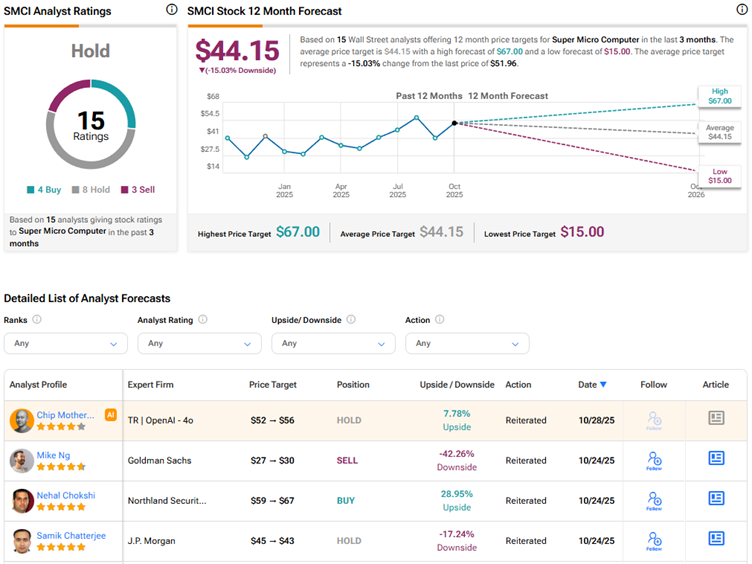

Currently, Wall Street has a Hold consensus rating on Super Micro Computer stock based on eight Holds, four Buys, and three Sell recommendations. The average SMCI stock price target of $44.15 indicates about 15% downside risk from current levels.