Solar power manufacturer SunPower (SPWR) and nine of its affiliates together filed for voluntary Chapter 11 Bankruptcy in Delaware yesterday. SunPower listed assets and liabilities to the tune of $1 billion to $10 billion in the filing. The company will slowly wind down its entire operation while selling certain assets and liabilities. The solar energy sector has been hammered by the high rates in California and changes to the state’s subsidy program, which drove away solar customers.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Richmond, California-based SunPower was one of the leading players in residential solar technology and energy solutions. However, SPWR shares have lost 83.3% so far in 2024, as a series of headwinds led the company to halt certain operations, announce mass layoffs, and face negative analyst reactions.

Stalking Horse Agreement with Complete Solaria

As part of the liquidation process, SunPower entered into a Stalking Horse Agreement with California-based Complete Solaria (CSLR), which is also a solar technology solutions and installation services provider in the state. The latter will acquire SunPower’s Blue Raven Solar Business, New Homes business, and non-installing Dealer network as well as certain related debt for $45 million in cash. SunPower had bought Blue Raven for $165 million in 2021.

A Stalking Horse bid provides a starting point or offer that must be surpassed by other potential bidders to acquire the assets or the business. The agreement is subject to Court approval and the transaction is expected to close by mid-to-late September. SunPower said that it expects to sell the remaining assets in a structured manner, liquidate any remaining assets, and then completely wind down its operations.

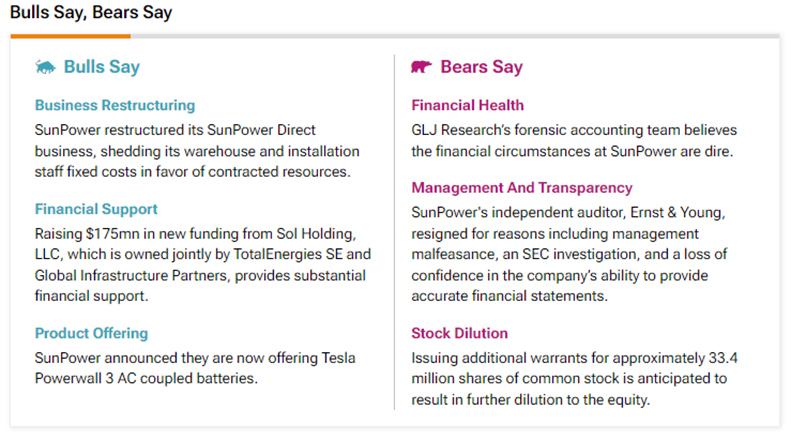

Insights from TipRanks Bulls Say, Bears Say Tool

The TipRanks Bulls Say, Bears Say tool, gave insights into analysts’ thoughts about SunPower’s dire state. The Bears were seemingly cautious of its financial position, SEC investigation, and equity dilution. All these were signals that SunPower was headed for real trouble.

Is SunPower Stock a Good Buy?

With the latest headlines about bankruptcy, SPWR stock is surely not one to buy. On TipRanks, SPWR has a Moderate Sell consensus rating based on five Hold and four Sell recommendations. The average SunPower price target of $3.01 implies 272.6% upside potential from current levels. These ratings are subject to change as analysts might revisit their recommendations following the news.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue