Shares of Constellation Brands (NYSE:STZ) gained in pre-market trading yesterday after the producer of beer, wine, and spirits reported adjusted comparable earnings for the first quarter of $3.57 per share, compared to $3.04 in the same period last year. This was above consensus estimates of $3.46 per share.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Constellation Brands’ Sales Breakdown

The company behind brands like Corona posted net sales of $2.66 billion, an increase of 6% year-over-year. This fell short of analysts’ expectations of $2.67 billion.

When it comes to Constellation’s beer business, it achieved a solid 8% increase year-over-year with sales of $2.27 billion and shipment volumes increasing by 7.6% year-over-year to 115.1 million. This business saw its depletion volume rise by 6.4%. Depletion volume is the rate at which products are sold at the retail level.

The company’s beer business was the biggest contributor with a more than 80% share of its total Q1 revenues of $2.66 billion.

STZ’s Dividends and Buyback

The company has declared a quarterly dividend of $1.01 per share of Class A common stock, payable on August 23 to stockholders of record as of the close of business on August 14, 2024. STZ returned over $240 million to shareholders in stock buybacks through June 2024.

STZ’s FY25 Outlook

Looking forward, management now expects its FY25 net sales to grow in the range of 6% to 7%. STZ updated its FY25 earnings outlook to between $14.63 and $14.93 per share and affirmed its comparable earnings forecast in the range of $13.50 to $13.80 per share.

Should I Buy STZ Stock?

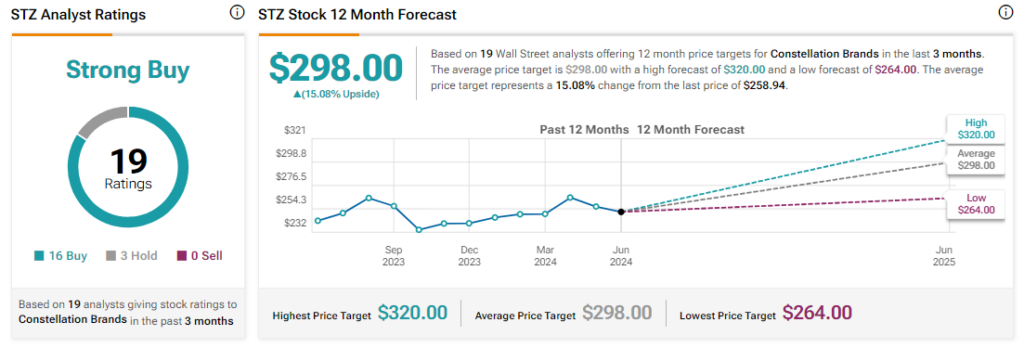

Analysts remain bullish about STZ stock, with a Strong Buy consensus rating based on 16 Buys and three Holds. Over the past year, STZ has increased by more than 6%, and the average STZ price target of $298 implies an upside potential of 15.1% from current levels. However, these analyst ratings are likely to change following STZ’s earnings today.