State Street (NYSE:STT) shares are on the rise today after the financial services major reported robust numbers for the first quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

STT Exceeds Expectations

During the quarter, revenue ticked up by 1.3% year-over-year to $3.14 billion, outpacing expectations by $80 million. EPS of $1.69 came in better than estimates by $0.20. On a year-over-year basis, State Street’s total fee revenue increased by 4% to $2.42 billion. However, its net interest income (NII) declined by 7% to $716 million.

State Street’s Impressive Asset Growth

Its return on average common equity (ROE) contracted to 7.7% from 9.3% in the year-ago period. At the same time, STT’s AUM (Assets Under Management) grew at a healthy 20% year-over-year to $4.34 trillion. Similarly, the company’s AUC/A (Assets Under Custody or Administration) jumped by 17% to $43.9 trillion, due to an influx of new business wins and client flows. During the quarter, STT clocked an impressive $474 billion in new servicing wins under AUC/A.

What Is the Price Target for State Street?

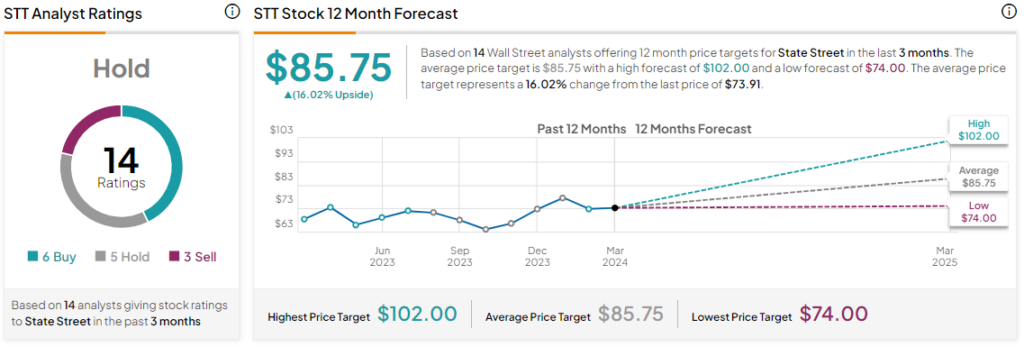

Today’s price gains add to the nearly 17% rise in STT’s share price over the past six months. Overall, the Street has a Hold consensus rating on the stock. Additionally, the average STT price target of $85.75 points to a 16% potential upside in the stock. However, analysts’ views on State Street could see a revision following today’s earnings report.

Read full Disclosure