Shares of State Street (STT) declined in trading even as the company reported robust Q4 results. The financial services company reported adjusted earnings of $2.60 per share, above consensus estimates of $2.44 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

STT’s Q4 Revenues Rise on Higher AUM Fee Revenue and NII

Furthermore, the company’s revenues increased 12% year-over-year to $3.4 billion in the fourth quarter. This exceeded Street estimates of $3.33 billion. Additionally, the company’s net interest income (NII) increased 10% to $749 million. Net interest income is a key financial metric for banks and financial institutions to measure the difference between the interest income earned on their assets (like loans, investments, or securities) and the interest paid on their liabilities (such as deposits, borrowed funds, or debt).

In addition, the company benefited from an increase in assets under management (AUM), which rose 15% to $4.72 trillion, driving fee revenue to $2.66 billion, up from $2.37 billion a year earlier.

STT Announces Appointment of Interim CFO

The company announced that Mark R. Keating would step in as interim CFO, succeeding Eric Aboaf, who will join S&P Global as finance chief in February.

Looking ahead, State Street forecasts fee revenue growth of 3% to 5% in 2025, although NII is expected to remain flat.

Is State Street Stock a Good Buy?

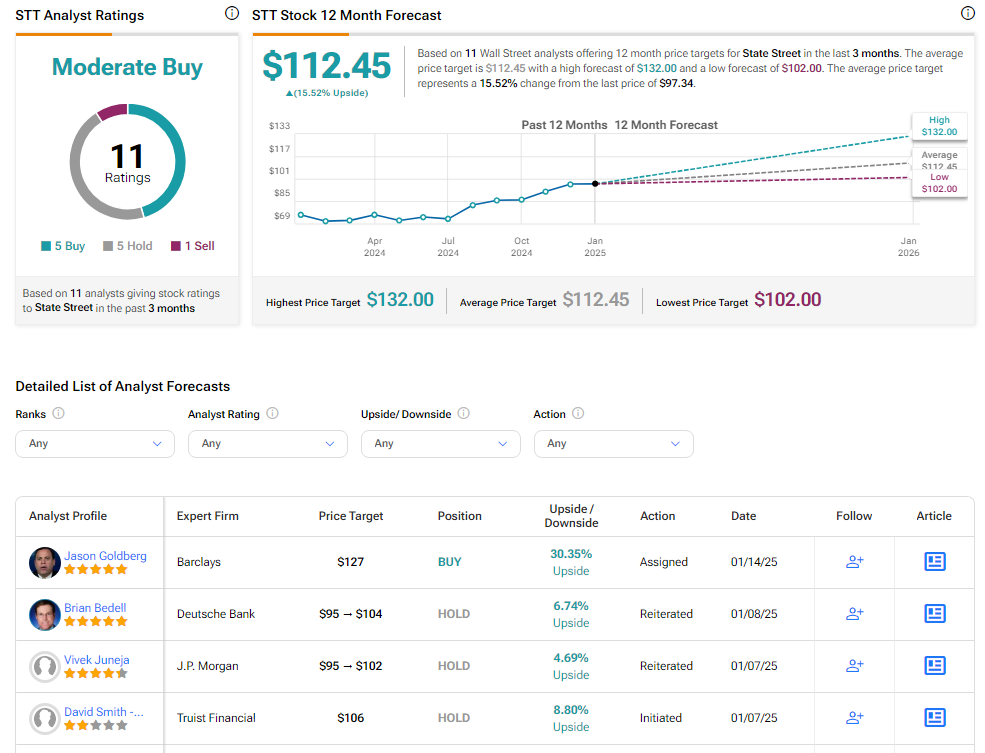

Analysts remain cautiously optimistic about STT stock, with a Moderate Buy consensus rating based on five Buys, five Holds and one Sell. Over the past year, STT has increased by more than 30%, and the average STT price target of $112.45 implies an upside potential of 15.5% from current levels.