While retail traders fretted over Bitcoin’s 4% slide this month, Michael Saylor’s MicroStrategy (now simply known as Strategy) (MSTR) treated the volatility as a year-end clearance sale. The company disclosed the purchase of 22,628 Bitcoin in December, capping off its most aggressive year of accumulation yet.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

By the end of 2025, Strategy had disclosed purchases in 41 separate weeks, a massive jump from just eight weeks in 2023. The company has now pivoted into what Saylor calls a “capital markets platform,” using debt to stack sats at a scale that traditional ETFs can’t replicate. With over 670,000 BTC on the books, Strategy’s treasury is now worth approximately $60 billion, solidifying its position as the ultimate Bitcoin proxy.

RWAs Flip DEXs

The biggest structural shift in DeFi this December wasn’t about a new meme coin; instead, it was the rise of Real-World Assets (RWAs) that stole the spotlight. For the first time, the total value locked in RWA protocols, led by tokenized U.S. Treasuries, surpassed that of Decentralized Exchanges.

The category grew 3% in December alone, crossing the $19 billion mark. Heavyweights like BlackRock’s BUIDL fund and Franklin Templeton’s BENJI have turned boring government debt into high-yield, on-chain collateral. As Kronos Research CIO Vincent Liu noted, the growth is no longer just “experimental,” it’s being driven by massive balance sheet incentives as institutions look for predictable yield in a volatile market.

Is Strategy a Good Stock to Buy?

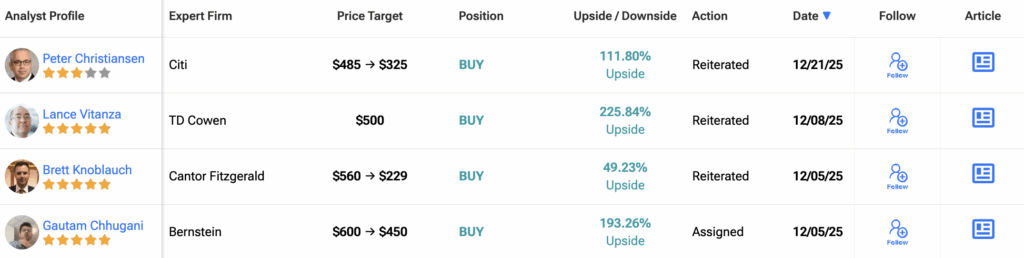

Turning to TipRanks, analyst data shows Wall Street remains firmly optimistic about Strategy (MSTR). In total, 14 analysts have weighed in over the past three months, and the consensus rating sits at Strong Buy. Out of these calls, 12 analysts call the stock a Buy, two say a Hold, and none recommend a Sell.

The average 12-month MSTR price target comes in at $467.75, which implies roughly 204.5% upside from the recent close.