Strategy (MSTR), the largest corporate owner of Bitcoin in the world, received a boost from Cantor Fitzgerald’s price target hike after the company posted strong Q2 earnings. Revenue came in at $114.5 million, just above expectations, but the highlight was its EPS of $32.60, well above the expected loss of $0.10. The jump was mainly due to a new accounting rule that lets MicroStrategy include unrealized Bitcoin gains in its income. By the end of Q2, it held 628,791 Bitcoin, the largest corporate stash in the world.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the results, Top analyst Brett Knoblauch of Cantor Fitzgerald lifted the price target on MSTR stock to $697, up from $680, while reiterating a Buy rating.

Why Cantor Sees MSTR Leading the Bitcoin Race

Knoblauch called MicroStrategy his “top pick” among companies holding Bitcoin. He pointed to the company’s massive Bitcoin position of 628,791 tokens, which he said was unmatched. He believed no other firm was likely to catch up, giving MicroStrategy a strong edge as demand for Bitcoin exposure continued to grow.

He also pointed to MicroStrategy’s strong access to capital as a key strength. He noted that the company could raise funds through equity, options, convertible notes, and preferred shares. This gave it more ways to expand its Bitcoin holdings without hurting current shareholders.

Knoblauch said he expected the stock to continue trading at a premium to its net asset value, which stood at around 1.8 times, due to its large scale and smart strategy.

To add to the context, late last month, MSTR issued a new preferred stock called “Stretch,” offering a 9% yearly payout and no maturity date. The initial offering was for $500 million, but strong demand pushed it up to $2.8 billion.

Is MicroStrategy a Good Stock to Buy?

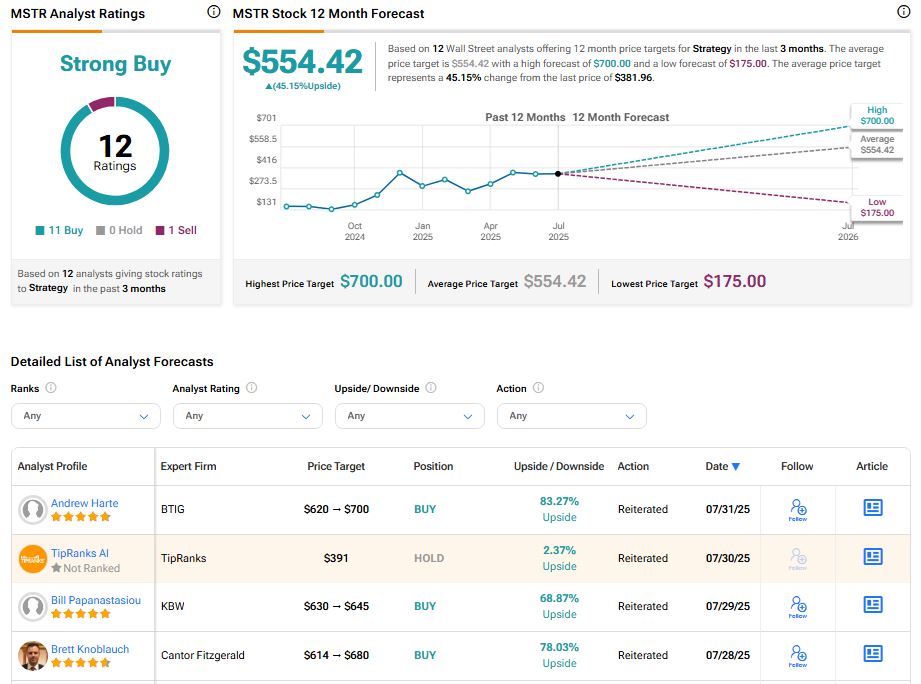

Overall, Wall Street has a Strong Buy consensus rating on Strategy (formerly known as MicroStrategy) stock based on 11 Buys versus one Sell recommendation. The average 12-month MSTR price target is $554.42, implying 45.15% upside potential.